CRU

January 7, 2025

CRU: Iron ore down due to falling hot metal production in China

Written by Liz Gao

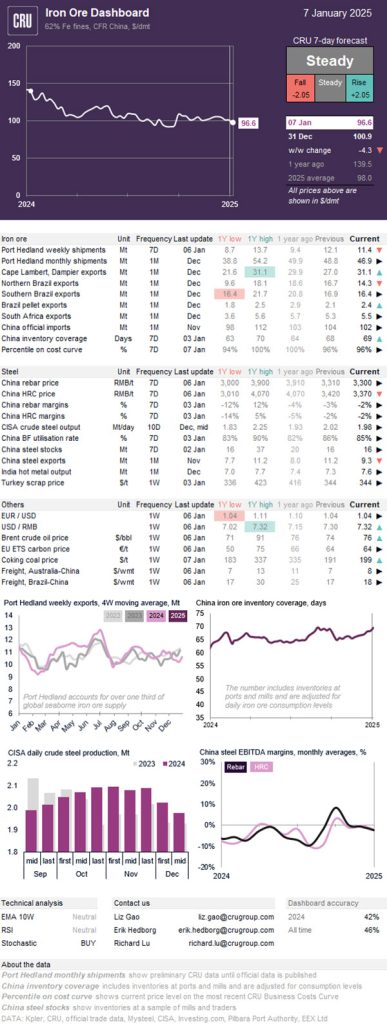

Iron ore prices declined in the first week of 2025, driven by reduced hot metal production in China. A bleak outlook for steel demand has undermined market confidence, contributing to the drop in prices.

Seasonal demand weakness has become increasingly evident. China’s steel market opened 2025 on a downward trajectory. Demand for HRC has dropped from previous levels and continues to decline while we see a clear downtrend in rebar demand. Falling steel prices have been exacerbated by weak consumption and limited pre-holiday restocking. As a result, hot metal production has declined sharply. The surveyed BF capacity utilisation rates has now fallen below 85%, leading to reduced iron ore consumption. Steel mills continue to restock and onsite inventories at mills are now exceeding levels recorded at the same time last year (according to China’s lunar calendar).

Port Hedland shipments started the year at 11.4 million metric tons (mt), marking 2 million mt increase from the same period last year. December shipments were low due to port maintenance and rainfall. Despite this, Port Hedland registered 568 million mt of shipments in 2024 – 16 million mt higher than in 2023. This robust performance is largely driven by BHP and Fortescue’s ramp-up of Iron Bridge, while Roy Hill saw its first annual decline in iron ore exports. Rio Tinto was less affected by the December rainfall and posted very strong export numbers from Cape Lambert and Dampier.

Looking ahead to next week, weather conditions are expected to remain stable, with no disruptions anticipated as the only “tropical low” observed is moving away from West Pilbara. Brazilian iron ore exports in December came in at 30.7 million mt, falling to their lowest December level in the past four years. The decline was driven by maintenance work in Itaguaí port and heavy rainfall in São Luis, resulting in low shipments from Vale’s Northern and Southern System. As a result, shipments arriving in China in the coming weeks are expected to experience a corresponding slowdown.

We expect iron ore prices will remain under pressure next week, as modest restocking is unlikely to offset the impact of declining consumption. Additionally, with Trump set to begin his second term as US president in two weeks, mounting concerns about China’s economic recovery have eroded investor confidence. As a result, iron ore prices are expected to face increased downward pressure in the near term.

NOTE: There are two price assessments for iron ore and coal displayed on this page, both sets of prices are published weekly each Tuesday. The assessments in the column on the right represent the average of market prices over the past week and are available in online tables, workbooks and Data Lab. The assessments in the dashboard below include only price information for Tuesday up to market close in Asia and are only available in this dashboard.

This analysis was first published by CRU. To learn about CRU’s global commodities research and analysis services, visit www.crugroup.com.