Product

June 8, 2025

SMU Scrap Survey: Sentiment little changed despite uncertainty on demand, trade policy

Written by Michael Cowden

Both current and future scrap sentiment as measured by SMU’s Scrap Market Survey are little changed from last month.

The relative stability might reflect June’s sideways settlement. But both measures remain below where they were earlier this year.

That trend might result from lingering concerns about the supply-demand balance as well as continued uncertainty over US tariff and trade policy, according to comments from survey respondents.

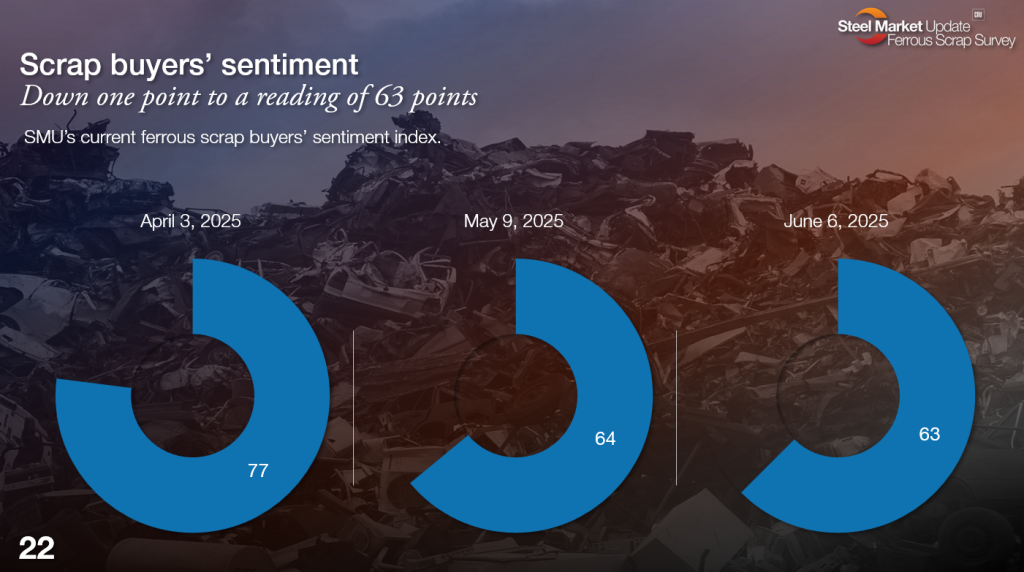

Current Sentiment Index

SMU’s Current Sentiment Index for scrap slipped one point to 63 in June after registering 64 in May. It remains notably lower than 77 in April.

(Editor’s note: You can click on the images below to expand them. The page numbers in the lower left-hand corner show where you can find them in the slide deck with the full survey results. A copy of that deck is here.)

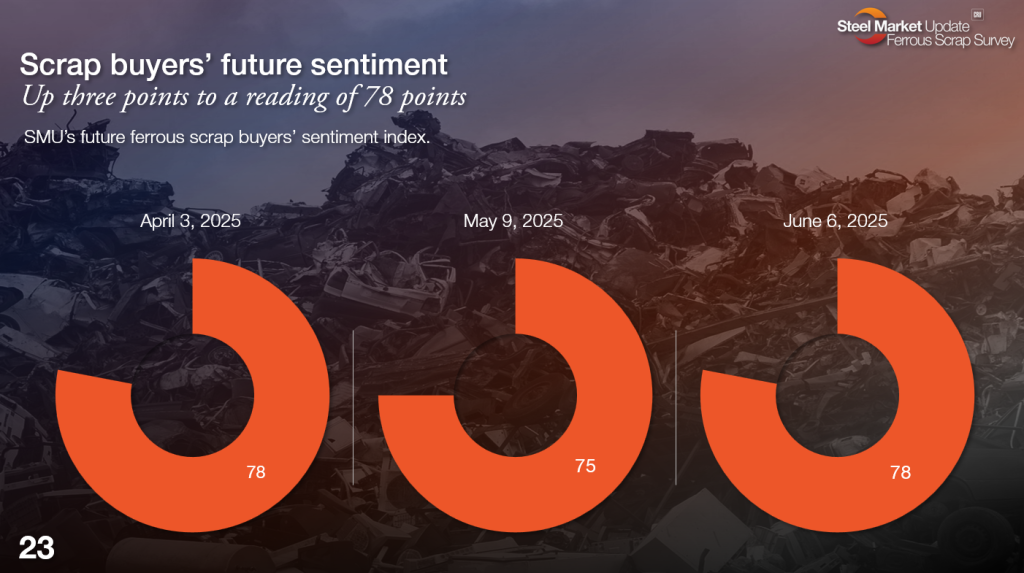

Future Sentiment Index

SMU’s Future Sentiment Index for scrap was also little changed. It stands at 78 for June, up three points from 75 in May and even with April’s reading.

Future Sentiment, however, is significantly lower than the 86 reading in March, before “Liberation Day” tariffs rattled steel and other markets.

Market reaction

Here is what some survey respondents to SMU’s latest scrap survey had to about the market:

“It’s difficult to determine the impact on scrap demand from new tariffs. It will take a month or two to determine.”

“It is really confusing. Supposedly steel production is up. But scrap demand is not.”

“Decent demand, too much supply.”

About SMU’s Scrap Sentiment

SMU’s Current and Future Scrap Sentiment Indices mirror our Steel Buyers’ Sentiment Indices in our flat-rolled steel survey. Our Scrap Sentiment Indices are both a diffusion index. A reading above 50 indicates a more bullish outlook. A reading below 50 indicates a more bearish one.

Sentiment is only one of the indicators we measure. Our scrap survey, like our steel survey, is available only to premium members. If you would like to upgrade from executive to premium, please contact SMU account executive Luis Corona at luis.corona@crugroup.com.