Analysis

June 13, 2025

CRU: Sheet demand remains weak, tariff changes again alter markets

Written by Ryan McKinley

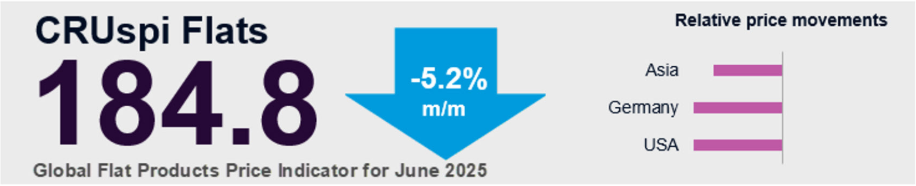

The CRUspi moved 5.2% lower m/m, driven by demand weakness around the world. Meanwhile, there have once again been major changes to the US market in regard to tariffs, and the situation remains fluid. Chinese exporters have grown more aggressive as demand falls in their own market, and this has provided additional downside pressure to global prices.

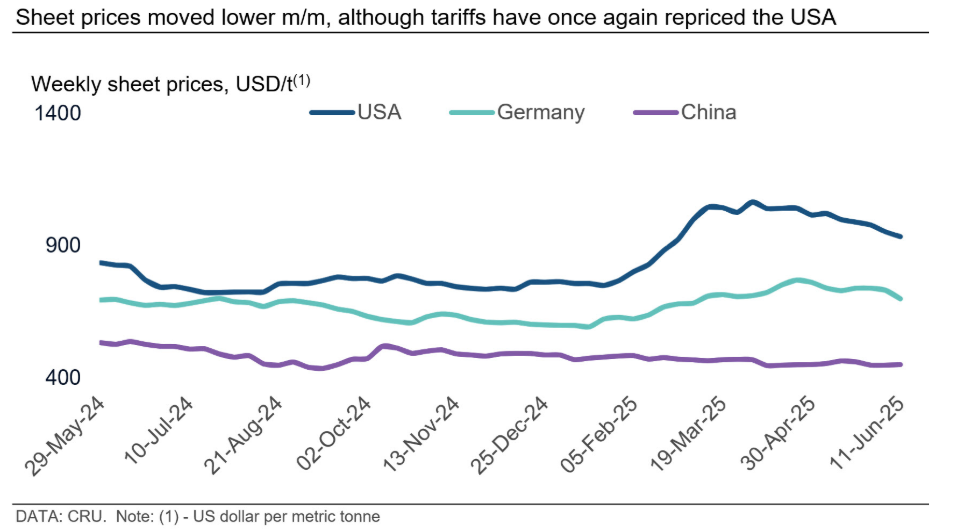

Subdued demand has continued to weigh on global sheet prices around the world. While an increase in Section 232 tariffs has recently started to support US pricing, price declines were still visible on a m/m basis across all other regions. In Europe, demand remains modest, while exporters out of China continue to vie for market share abroad as domestic demand falters.

Buyers in the US have started to return to the market after a period of demand weakness and perpetually falling prices. With the surprise announcement by President Donald Trump that existing steel import tariffs were going to be increased from 25% to 50%, lower-priced deals from domestic producers rapidly evaporated from the market. Meanwhile, the tariff increase also set a new floor for pricing, and importers have scrambled to either cancel orders or negotiate with exporters on who will be responsible for paying for the tariff rise.

Meanwhile, although prices in Europe have not collapsed, demand remains modest even for attractively priced import offers. This is because inventory levels remain relatively elevated, and key end-use sectors have struggled to gain ground. Many market participants are now engaged in H2’25 contract negotiations, although these remain in flux as current spot prices continue over those from last year. At the same time, import offers will continue to weigh on the market, especially from Asia.

In Asia, the dominant story is that Chinese exporters are competing heavily for business as their own domestic demand wavers. China has entered a seasonally weak period of demand, with inclement weather impacting construction projects, and there have been revisions to stimulus measures that are also leading the market there lower. Chinese exporters have, so far, been able to outcompete exporters and domestic providers in other countries in Asia, leading to lower domestic prices across the continent. In addition, stiff tariff barriers in the US are helping depress demand from steel-intensive sectors that are oriented to exports.

This Insight piece was first published by CRU. To learn about CRU’s global commodities research and analysis services, visit www.crugroup.com.