Plate

March 19, 2017

Comparison Price Indices: Changes in Galvanized & Plate

Written by John Packard

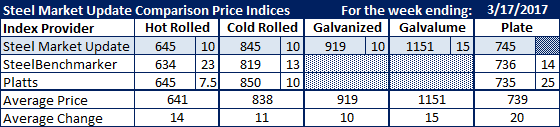

You will notice a couple of changes in our Comparison Price Indices (CPI) report. The U.S. and Canadian steel mills have adjusted their extras for placing zinc on the surface of steel (galvanized). One of the items referenced in the CPI is .060” G90 which prior to this week was based on a $3.45/cwt ($69 per ton) extra. This was based on U.S. Steel galvanized coating extras which many mills tend to follow. The extras changed to $3.90/cwt ($78 per ton) effective with April 2017 orders and we are reflecting that change in the galvanized number shown in the CPI table below.

A second change of note to our readers is we are beginning to provide a range and average for plate. We will provide our new plate pricing on Tuesday evenings with our hot rolled, cold rolled, galvanized and Galvalume indices. The plate prices referenced below and in our Tuesday evening newsletter issue will be FOB Mill, east of the Rocky Mountains.

This week flat rolled and plate prices rose once again as the domestic mills tighten their spot pricing positions.

Hot rolled prices were up $7.50 to $23 per ton depending on the index. Both Platts and Steel Market Update have HRC averaging $645 per ton while SteelBenchmarker, which only produces prices twice per month, reported HRC as being $634 per ton.

Cold rolled was up double digits on all three indexes but there is quite a spread between SteelBenchmarker and SMU/Platts. SteelBenchmarker has CRC at $819 per ton while SMU came in at $845 per ton and Platts at $850 per ton.

Galvanized prices were up $19 per ton but $9 of that increase is due to the change in the coating extras.

Galvalume was up $15 per ton.

Plate spot prices range from Platts $735 per ton, SteelBenchmarker at $736 per ton and SMU first CPI plate spot number is $745 per ton.

SMU Note: Galvanized prices include $78 in extras for a .060″ G90 product. Galvalume prices include $291 in extras for a .0142” AZ50 Grade 80 product.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.