Market Data

April 20, 2017

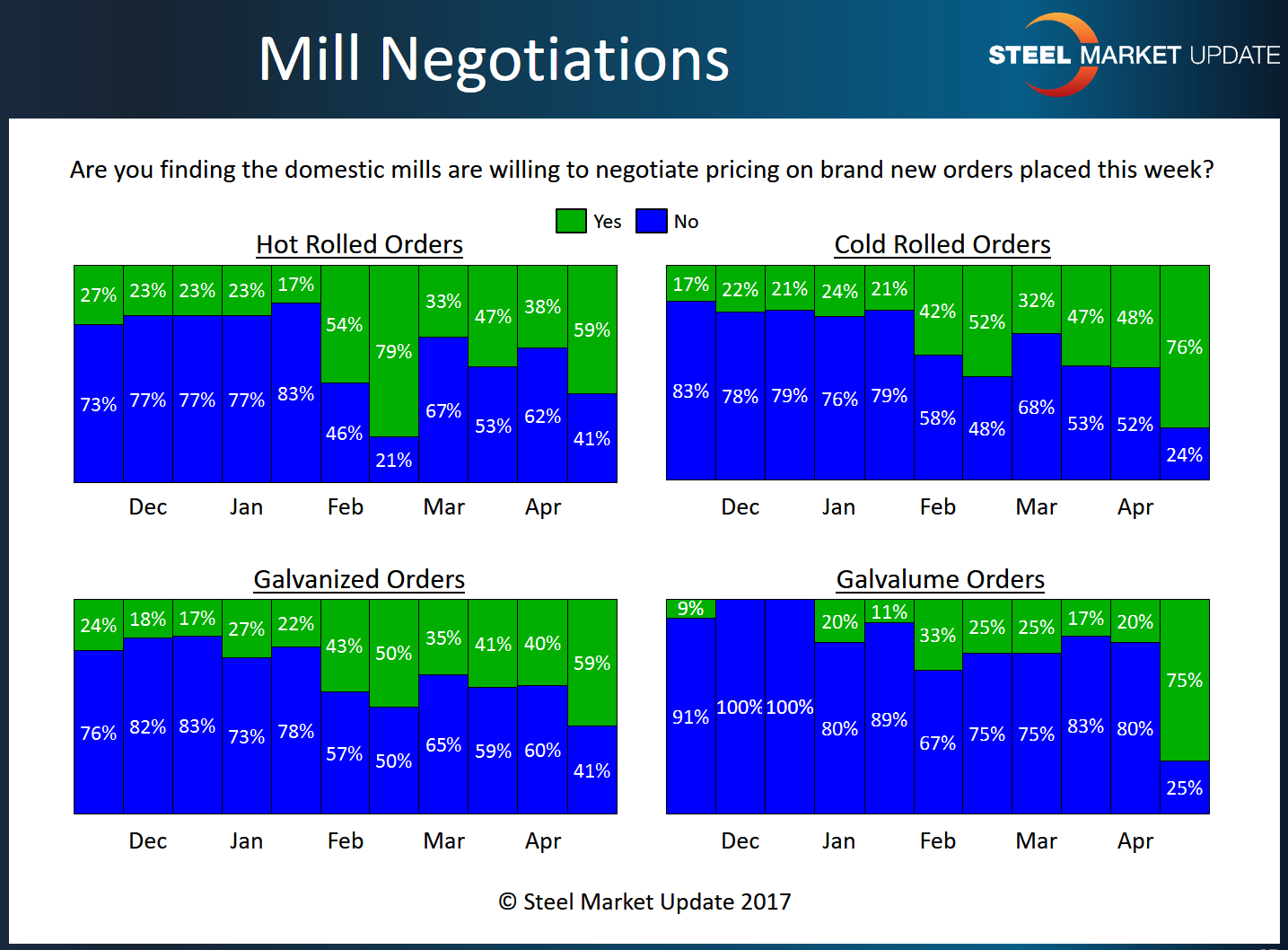

SMU Survey Results: Steel Mills Willing to Negotiate Steel Prices

Written by John Packard

Buyers and sellers of flat rolled steel associated with manufacturing companies and service centers are reporting the steel mills as being more willing to negotiate flat rolled steel spot prices.

Based on the responses from those taking our survey, 59 percent reported the domestic steel mills as willing to negotiate hot rolled prices, 76 percent reported mills as willing to negotiate cold rolled prices, 59 percent reported the mills as willing to negotiate galvanized prices and 75 percent said the mills were willing to negotiate Galvalume prices.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.