Market Data

September 17, 2019

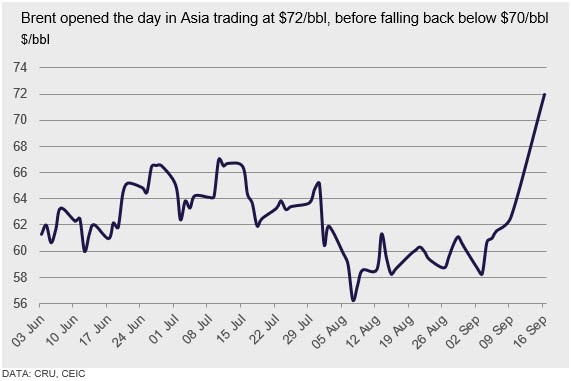

CRU: Oil Prices Soar as Major Saudi Oil Facility Attacked

Written by Tim Triplett

Editor’s note: This story is still developing. Since this reporting, Saudi Arabian officials claim they have already restored 50 percent of their lost production and that they expect oil output to fully recover within weeks. On Tuesday, oil prices corrected back down by about 6 percent on the news that Saudi production would recover more quickly than anticipated.

By CRU Cost Economist Ross Cunningham

A drone attack over the weekend on Saudi Arabia’s strategically exposed Abqaiq oil facility caused oil prices to skyrocket when markets opened this morning. Brent crude prices opened the day’s trading around $72/bbl—up more than 20 percent (the largest daily price move in almost three decades) as panic set in around the extent of damage. Saudi officials have confirmed that 5.7Mbbl/d of production has been impacted, equating to roughly half of their total production and 5 percent of world supply.

Yemeni Houthi rebels have claimed responsibility for the attack; however, the U.S. has firmly pointed the finger at Iran. This marks further escalating tensions between the two nations at a time where relations have been poor, e.g. the Strait of Hormuz. President Trump tweeted not long after the attack that they were “locked and loaded depending on verification” in reference to the U.S. army.

Prior to the attack, the words “supply” and “fears” were not used in the same sentence. Global crude stocks were high, production levels in the U.S. continued at record levels and Saudi Arabia was the biggest contributor of 1.2Mbbl/d supply cuts from within OPEC+.

The extent to which the attack impacts the global oil market will depend on several factors:

1. How easily can Saudi Arabia mitigate the loss of production and get things back on track? Some report 40 percent of the lost production has already been made up. If that’s the case, then it’s the other 60 percent that will prove significant.

2. “PLENTY OF OIL” – Will Saudi Arabia rely on the U.S., after President Trump authorized strategic reserves to be tapped if needed?

3. Will Saudi Arabia ask other OPEC+ nations to increase production to alleviate supply concerns in the short term?

4. Will there be retaliation? Almost as important to the short-term loss of 5 percent of global supply is the fear that tensions in the Middle East will escalate further. Saudi Arabia accounts for 10 percent of global supply. Although Iran is currently under sanctions from the U.S., the Strait of Hormuz, a critical chokepoint for one-third of global oil supply, is effectively controlled by Iran.

One thing is for sure—prior to the attack, all eyes were fixed on the slowing global economy and its impact on oil demand. Now supply is firmly back in the picture, and we will see price volatility in the short term. The extent of this volatility is firmly based on the results of the four factors highlighted above. Our current Brent crude forecast is $65.25/bbl for 2019 and $67.50/bbl in 2020. While our forecast remains unchanged, the balance of risk in the near term has moved to upside supply risks, and we will continue to monitor the situation closely.