Market Segment

February 20, 2020

Reliance Sets Annual Records, Optimistic About 2020

Written by Sandy Williams

Reliance Steel & Aluminum announced a slew of records for its performance in 2019 and an increase in net income for the fourth quarter of 2019.

“We challenged ourselves to drive continuous improvements in our business in 2019 and we are extremely pleased with the outcome of our performance,” said President and CEO Jim Hoffman. “Following a record year in 2018, our unique business model enabled us to execute our strategy and achieve record earnings levels, despite both demand and pricing pressure on our top line”

Net income for the quarter was $165.6 million on net sales of $2.4 billion. Income increased 1.8 percent from the third quarter, while sales decreased 8.9 percent.

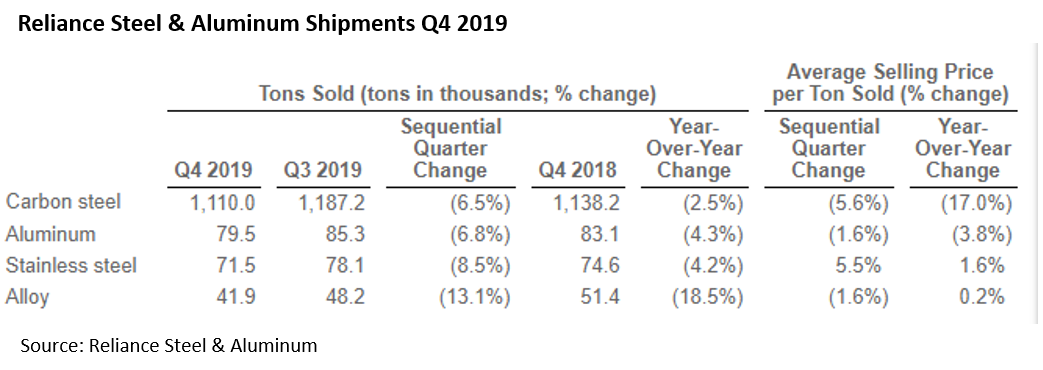

Tons sold in Q4 slipped 6.8 percent to 1.375 million compared to the third quarter. Average selling price was $1,747 per ton, down 2.4 percent sequentially.

Results for full-year 2019 include net sales of $11 billion, a 4.9 percent decline year over year as carbon products remained under price pressure.

Added Hoffman, “Our 2019 results once again demonstrate the strength of our proven business model, increased resilience to fluctuations in metal pricing and strong earnings power due to the diversity of our products, end markets and geographies, as well as our increased focus on value-added processing. Through our ongoing investments in equipment, we performed value-added processing on 51 percent of the orders we shipped in 2019, up from 49 percent in 2018 and our more historical rate of about 40 percent.”

Record-setting achievements for the year include:

- annual gross profit margin of 30.3 percent that drove record annual gross profit dollars of $3.33 billion

- pretax income of $929.3 million

- net income of $701.5 million

- earnings per diluted share of $10.34

- cash flow from operations of $1.30 billion

- a 13.6 percent increase in the quarterly dividend to $0.625 per share

During the fourth quarter Reliance acquired Fry Steel Co., a general line and long bar distributor. It also started FastMetals Inc., an online catalog option for small businesses offering a diverse selection of metal products including carbon, stainless, aluminum and specialty alloy steels. Reliance continues to look for acquisition opportunities to help meet customer demand for value-added products.

Reliance noted strong demand in nonresidential construction, particularly in carbon structurals and tubing. The auto industry is mostly served by Reliance through toll processing in the U.S. and Mexico and is showing continuing strength in high-strength steels and aluminum. Reliance will complete expansions at three facilities serving the auto industry in Mexico by the end of first quarter.

Customer optimism is good, orders are coming in and distribution doing well, said Hoffman. A buildup of inventory in 2018 resulted in destocking in 2019. Inventory is currently in good shape, added CFO Karla Lewis.

The company is excited about the transition to electric vehicles and said it will be able to support any future metal needs of customers.

Issues for Boeing’s 737 Max jet led Reliance to adjust inventory and headcount last year. Aerospace in the commercial sector is weak, but is offset by increased volume in the defense sector. General engineering and semiconductor demand are also still strong.

The coronavirus is expected to have a minimal impact on Reliance operations in China. Most of the impact is due to the extended holiday and mandatory closures. Reliance still has a couple of operations in closed mode. All employees appear healthy, although a few are in quarantine.

Looking forward in Q1, Reliance expects tons sold to be up 6-8 percent and overall metal pricing to remain near current levels. Average selling price per ton is expected to increase 1-2 percent compared to the fourth quarter.