Product

January 9, 2013

Mill Lead Times & Negotiations

Written by John Packard

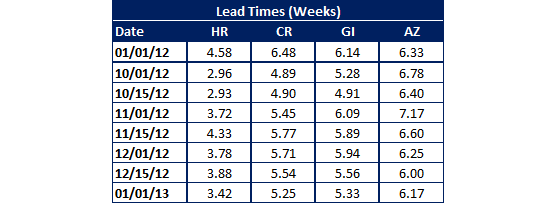

Mill lead times shrunk on all but Galvalume products according to the results of our most recent SMU steel survey completed this past Friday. On a weighted average basis hot rolled lead times shrunk to 3.42 weeks, cold rolled to 5.25 weeks, galvanized to 5.33 weeks while Galvalume lengthened to 6.17 weeks.

We provided the first week of January 2012 lead times for you to compare against the most recent data.

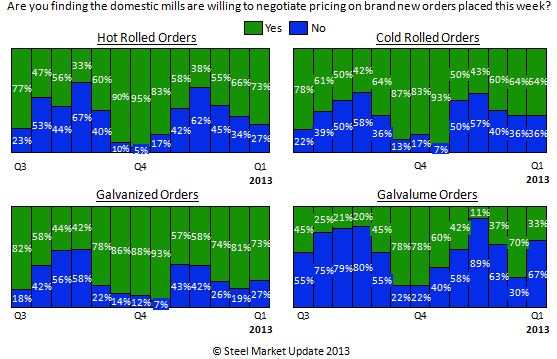

Mills were most receptive regarding negotiating prices on Hot Rolled – 73 percent, up from 66 percent in mid-December; Cold Rolled – 64 percent, remained the same as mid-December; Galvanized – 73 percent, down from 81 percent in mid-December and Galvalume – 33 percent, which is significantly higher than the 70 percent noted in mid-December.