Product

January 11, 2013

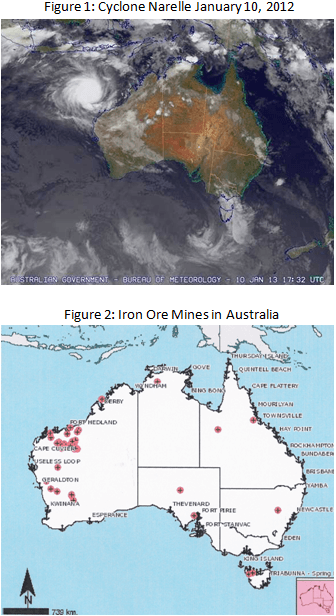

Cyclone Narelle Threatening Australian Mining Area

Written by Sandy Williams

Written by: Sandy Williams

Iron ore buyers have been watching with concern the path of Cyclone Narelle as it approaches the western shore of Australia. The west and northwest region contains 93 percent of Australia’s iron ore mines. In past years cyclones and flooding have disrupted mine operations for coal and iron ore sending steel prices soaring. Most are open cut mining operations that can be significantly affected by the weather, with impacts from wind, dust, and flooding. Recent weather related mine damage was recorded in 2007, 2008, 2010 and 2011, spiking the price of iron ore each time.

The cyclone is moving southwest and expected to intensify. Winds are likely to increase further by Saturday on the west Pilbara coast, possibly becoming destructive with wind gusts over 81 miles per hour overnight and gusts to 155 miles per hour near the cyclone center. Flooding is expected in low lying areas along with a very dangerous storm tide if the center of the cyclone passes close to the coast on Saturday night.

The cyclone is moving southwest and expected to intensify. Winds are likely to increase further by Saturday on the west Pilbara coast, possibly becoming destructive with wind gusts over 81 miles per hour overnight and gusts to 155 miles per hour near the cyclone center. Flooding is expected in low lying areas along with a very dangerous storm tide if the center of the cyclone passes close to the coast on Saturday night.

Recent climate changes have prompted the mining industry to look more seriously at extreme weather events and how to predict, and mitigate damage when it occurs. Risk to mines can be manifested in a variety of ways:

- Threats to mine water supply security

- Damage to mines and associated transport infrastructure from flooding, cyclones and bushfires

- Threats to port operations and infrastructure from sea level rise and storm surges

- Overtopping of tailings dams, leading to failure and environmental contamination

- Delays in construction of mine infrastructure or in production and shipping of product

- Human health threats for mine staff from changes in working conditions or disease prevalence

- Climate-related social dislocation and security concerns in communities around mining operation

- Changes in surface water and groundwater interactions, with implications for acid mine drainage or movement of contaminants

- Threats to vulnerable ecosystems in areas within mining operations from direct climate impacts or via climate sensitive agents, such as fire, pests, weeds or diseases. (Source: Sinclair Knight Mertz, 2011)

These risks can lead to operational delays, revenue losses, increased production and transportation costs, and labor shortages which, in turn, are passed on through price increases to buyers. Mines can be forced to idle while negotiating with government bureaus on how to move water from their sites to areas outside their environmental authority. The steel industry, as the major consumer of ore and coal, is vulnerable to price volatility caused by such extreme weather events.

John Anton, Director of IHS Steel Service, said in a in a recent discussion on price risk that he checks the weather in ore production areas every week. “I don’t know if weather will be bad this year,” he said, “but if it is, buy steel quick as you can, even if you have to borrow money or defer other projects.”