Product

January 11, 2013

Scrap, Billet, Iron Ore Futures

Written by Bradley Clark

Written by Brad Clark, Director of Steel Trading, Kataman Metals

U.S. Midwest #1 Busheling Ferrous Scrap (AMM) Heads South on Warmer Winter Weather

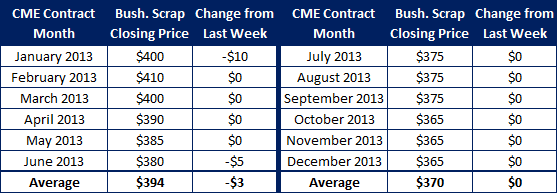

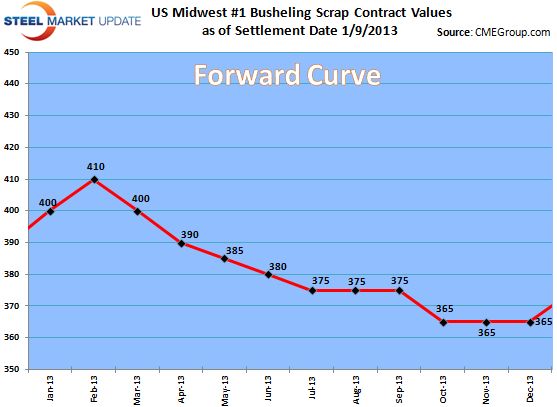

Historically January is the strongest month for busheling prices as cold weather constrains supply. This year however an unseasonably warm winter has kept a lid on any price spikes this past month for Midwest scrap. The physical market has concluded earlier this week with levels sideways from December, about $390 per gross ton for busheling.

The futures market has experienced decent volumes this week as prices trended lower as more info from the physical market emerged. January futures has been offered at $390 with no trades occurring on that period, while the February contract has traded down to $390 with offers looking to sell further at that level.

CME Busheling Closing Prices as of 1/10/2013 close:

Jan – 390

Q1 – 385

Q2 – 375

Cal 13 – 365

OPEN INTEREST: 112 lots (1 lot = 20 gross tons)

CME Black Sea Billet / TSI Turkish Scrap Picks up on increased Mill Buying

Raw materials markets continue to tick up this week as Turkish mills continued to buy both billet and scrap at higher than last done levels. Demand for billet is a bit less than for scrap as billet prices experienced less pronounced upward momentum gaining $3-5 per ton w-o-w. Export scrap into Turkey saw a greater increase in prices up closer to $10 dollars per ton. Futures markets for both have not experienced any trading to speak of this week as most in the market are happy to sit on the sidelines as the recent strength in pricing has many uncertain to how long these increases will last.

Forward curve TSI Turkish Scrap as of 1/10/2103 close:

Jan – 417

Q1 – 410

Q2 – 385

Cal 13 – 391

Forward curve CME Black Sea Billet as of 1/10/2013 close:

Jan – 540

Q1 – 547

Cal 13 – 533

TSI Iron Ore: Price Experience a Pull Back

The recent rally in iron ore prices over the past couple of months has been truly impressive sending prices to levels not seen in over 15 months. It is only to be expected after such a run on the futures market (q1 and cal 13 periods up over 30% in the past 7 weeks) to take a breather. This week we have seen this pull back in prices down the curve with the first half of 2013 prices coming down $7-10 with Q1 closing at $140 and q2 at $129.

While prices this week have softened, it is probably still too early to call the top of the market as the physical trade remains solid at these levels. With that said we are now sitting at historically very high levels while steel prices have not experienced as strong a move to the upside. Something will have to give in China either steel prices take a leg up or iron ore softens. Unless real demand surges for finished steel in China, iron ore probably starts to look toppy in the coming weeks.

Volumes this week have been exceedingly strong with 1 million tons going through virtually every day this week.

TSI Iron ore forward curve as of 1/10/2013:

Jan – 148.50

Q1 – 140

Q2 – 128

Cal 13 – 129.25