Product

February 4, 2013

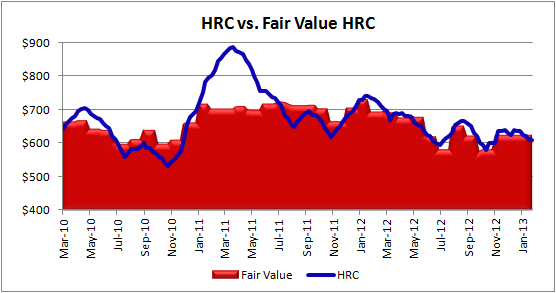

SMU Fair Value Model Has HRC Spot Pricing Below Fair Value for 3rd Week

Written by John Packard

This week, the SMU Fair Value HRC (hot rolled coil) Model has spot HRC pricing below Fair Value for the third week in a row after nine consecutive weeks of higher HRC prices. This is due to the SMU average spot HRC index remaining the same at $610 per ton and scrap inputs remaining the same over last week’s figures. The Fair Value model now shows HRC prices $13 below the estimated Fair Value price.

Scrap prices will be negotiated for the month of February in the coming days. At this moment the expectation is for price movements to potentially vary by product and by region. Our sources are reporting the best case scenario for the Midwest to be a flat or sideways move while there are those who believe prices could drop as much as $20 per gross ton. A sideways move on scrap inputs would keep our model at $13 below the estimated Fair Value price (assuming no change in HRC price assessment). If scrap drops as much as $20 that would have a positive impact on our Fair Value model and put HRC prices above Fair Value (assuming no change in the HRC price).

As a reminder, the Fair Value HRC Model below came from the SMU acquisition of Steel Reality. The graph below demonstrates the relationship between scraps inputs creating an estimated “Fair Value” for HRC versus the actual spot price.