Product

March 21, 2013

Mill Lead Times & Negotiations: Too Much Supply

Written by John Packard

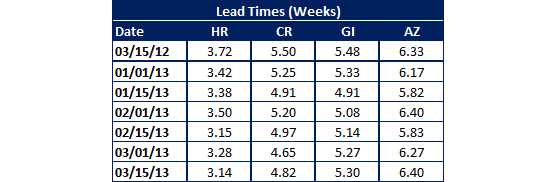

Lead times continue to be quite short on all but Galvalume. Hot rolled lead times retreated to —- weeks based on the results from our ongoing SMU steel survey. Cold rolled and galvanized lead times remained relatively stable compared to the beginning of the month.

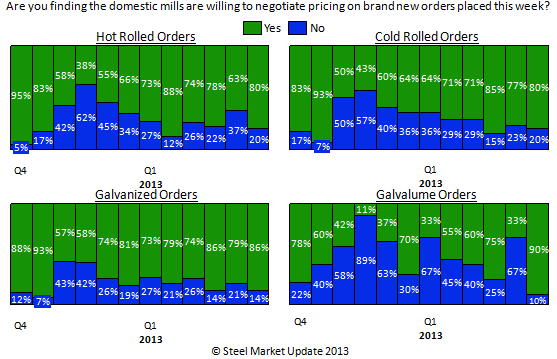

According to our survey responders, mills are more willing to negotiate all flat rolled products than what we saw earlier this month. This flexibility in price negotiations may well translate into lower steel prices going forward. Especially if found in combination with shorter lead times.