Product

August 16, 2013

Iron Ore & Scrap Futures

Written by Bradley Clark

U.S. Midwest #1 Busheling Ferrous Scrap (AMM) Typically Quiet Mid-Month Market

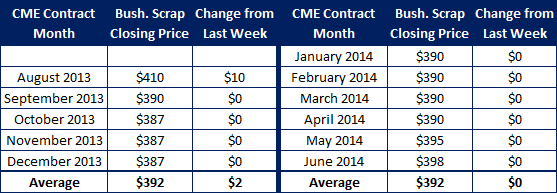

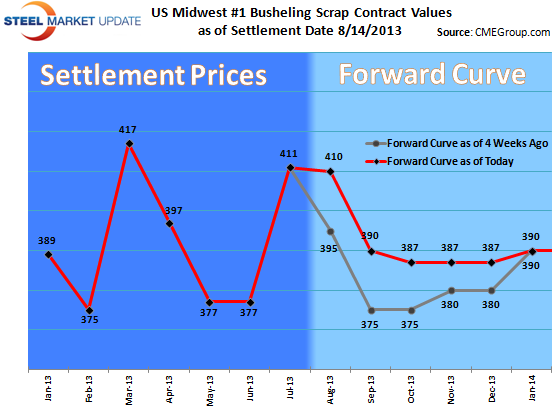

While the HRC futures market is experiencing a summer lull, the AMM Busheling contract has been virtually non-existent the past few weeks. After the physical market for busheling priced sideways this month the futures market has not reacted.

It seems that the usual pattern of a busy beginning of the month during the pricing period for the underlying market is followed by a sluggish middle of the month in the paper market. All eyes are on the physical market with close attention to what is happening in the export market to get some hints to how prices shape up in September. The early thoughts are that the market remains flat again in September as supply and demand looks to be fairly balanced.

There have been no reported trades this past week.

TSI Iron Ore: Prices Taking a Breather…

Iron ore continued to make new highs last week with the spot getting above $142 per ton for the first time since early spring. While the futures market experienced similar gains this past week, some profit taking was experienced today as the physical market looked to be taking a breather. Good economic news out of China continues to fuel the ideas that this recent rum up in prices will be maintained through the end of the year, however, the market remains very skittish at these high levels as many traders have the recent sharp decline in prices fresh in their minds.

Volumes on SGX remain very strong and the curve remains backwardated with September trading around $133, Q4 at $128 and cal 14 at $117.