Product

August 26, 2013

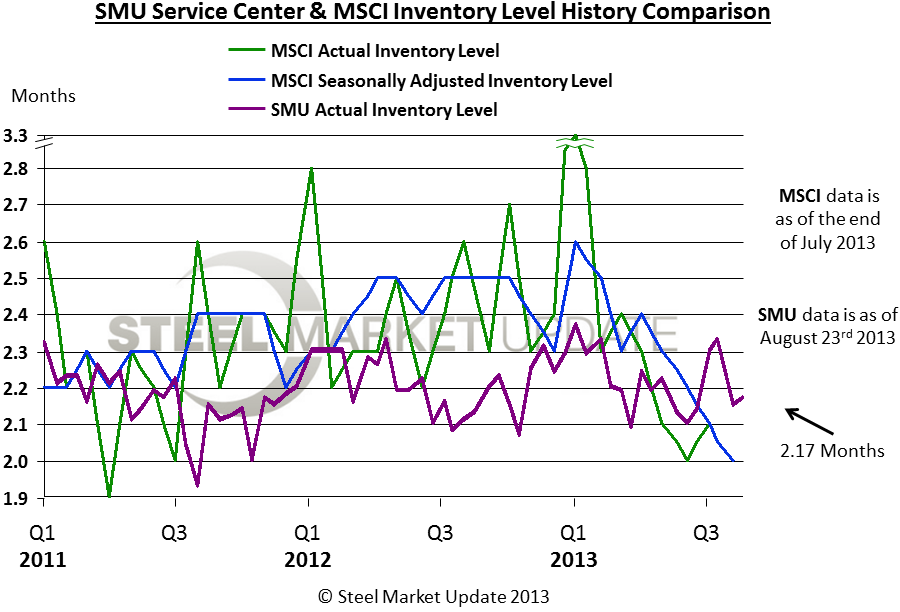

Service Center Inventories Remain Close to 2 Months Supply

Written by John Packard

Flat rolled steel service centers held 2.17 months of inventory on their floors, according to the results from our latest steel market survey completed on Thursday of last week. This is essentially unchanged from the 2.15 months measured at the beginning of the month and in line with the MSCI data reported at the end of July.

Both service centers and end user inventories remain relatively balanced. The percentage of service centers reporting their company was “maintaining” inventories levels was 70 percent at the beginning of August and 64 percent this past week. Manufacturers reported 71 percent at the beginning of August and 75 percent last week. Those distributors reporting their company as reducing inventory levels jumped from 17 percent the first week of August to 29 percent this past week. SMU believes this is due to the opinion at the service center level that mill prices have peaked. Manufacturers remained fairly stable with 19 percent reporting their company was reducing inventories at the beginning of August and last week 17 percent reported the same way. Those building inventories were in the single digits for both distributors (7 percent) and end users (8 percent).