Prices

August 28, 2013

July 2013 Imports Up from June but Down Compared to July 2012

Written by John Packard

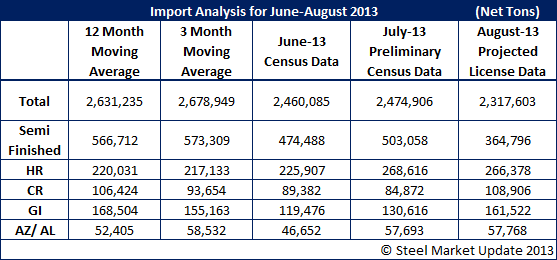

July imports rose slightly compared to June but were below the three month and twelve month moving averages. The SMU forecast for August imports is down slightly from July based on license data from this past week. We anticipate August imports to be 2.3-2.4 million tons.

Below is the press release from the American Institute for International Steel (AIIS) and their analysis of the July data:

Falls Church, VA, August 26, 2013 – Steel imports increased in July compared to June by 0.6 percent according to preliminary data released by the government. “Steel imports in July inched up by less than one percent as shipments from some non-NAFTA sources strengthened while NAFTA imports dropped, especially from Mexico. While the month to month improvement in arrivals for the month might be the beginning of a small upward trend in the market, imports remain substantially weaker than in 2012,” said David Phelps, president, AIIS.

Steel imports in the first seven months of 2013 compared to the same 2012 period were down by 10.8 percent. “While currently in a rebound for some products, demand in most steel markets has not returned even to 2012 levels for either the domestic industry or importers. Imports might show some improvement later this year in response to improved pricing this summer, but we do not see underlying demand strengthening sufficiently enough to improve conditions for domestic or import suppliers to the market at this time,” concluded Phelps.

Total Steel imports in July 2013 were 2.474 million tons compared to 2.460 million tons in June 2013, a 0.6 percent increase, and a 10.9 percent decrease compared to July 2012. For the year- to – date period, imports decreased from 20.409 million tons in the seven months of 2012 to 18.206 million tons in the same 2013 period, a 10.8 percent decrease.

The data show that imported semifinished products decreased by 6.7 percent in July 2013 compared to July 2012, from 556 thousand tons in 2012 to 519 thousand tons in 2013, based on preliminary reporting. For the year- to – date period, imported semifinished products decreased from 4.582 million tons in the first seven months of 2012 to 3.882 million tons in the same 2013 period, a 15.3 percent decrease. (Source: American Institute for International Steel)

SMU 3MMA & 12MMA and August Projection