Market Data

September 3, 2013

August in Review

Written by John Packard

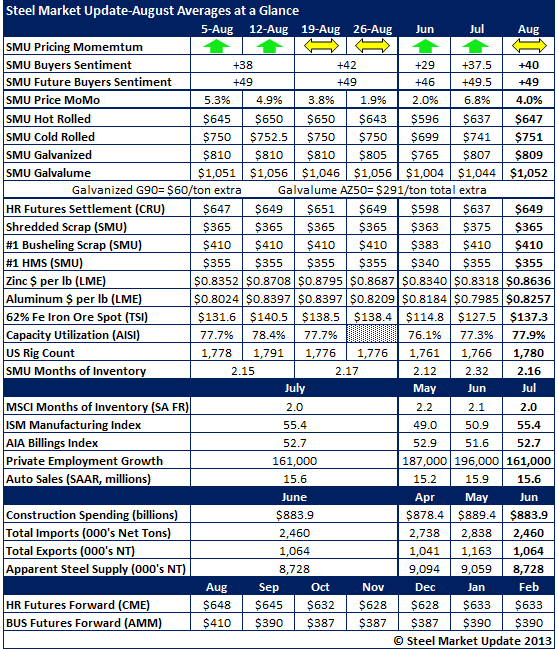

By the end of August SMU had adjusted our Price Momentum Indicator from Higher to Neutral, SMU Steel Buyers Sentiment Index averaged +40 which is higher than the average from June and July and well within the optimistic range of our Index.

Benchmark hot rolled prices moved essentially sideways as the numbers show below. Our SMU average of $647 was $2 per ton lower than the CRU average for the month of August.

Zinc and aluminum spot prices on the LME have barely budged during the month of July rising only a few pennies and having little impact on the cost to produce coated products.

Both the MSCI and SMU months of inventory on hand (flat rolled) are close to 2.0 months and are helping keep market prices firm.

Imports, exports and apparent steel supply were all lower in June than the prior two months.