Prices

September 10, 2013

Apparent Steel Supply – Analysis

Written by Peter Wright

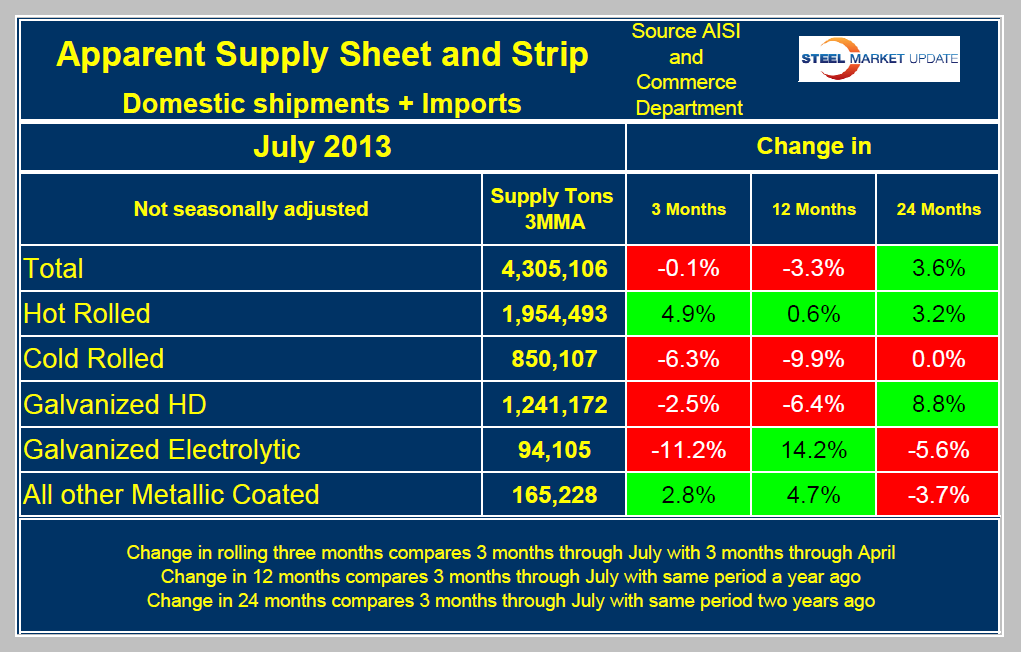

Apparent steel supply is defined as domestic mill shipments to domestic locations plus imports. Sources are the American Iron and Steel Institute and the Department of Commerce. The three month moving average (3MMA) of the total tonnage of flat rolled steel sheet and strip supply was 4,305,106 tons per month in the period May through July. This was down by 0.1 percent from the February through April period and down by 3.3 percent from May through July 2012.

Table 1 shows the performance by product over three, twelve and twenty four month periods. Hot rolled and other metallic coated, (mostly Galvalume) were up in the most recent three month period as other sheet products declined. Year over year hot rolled, electrolytic galvanized and other metallic coated strengthened as cold rolled and hot dipped galvanized declined. Electro galvanized did particularly well year over year being up by 14.2 percent as hot dipped declined by 6.4 percent.

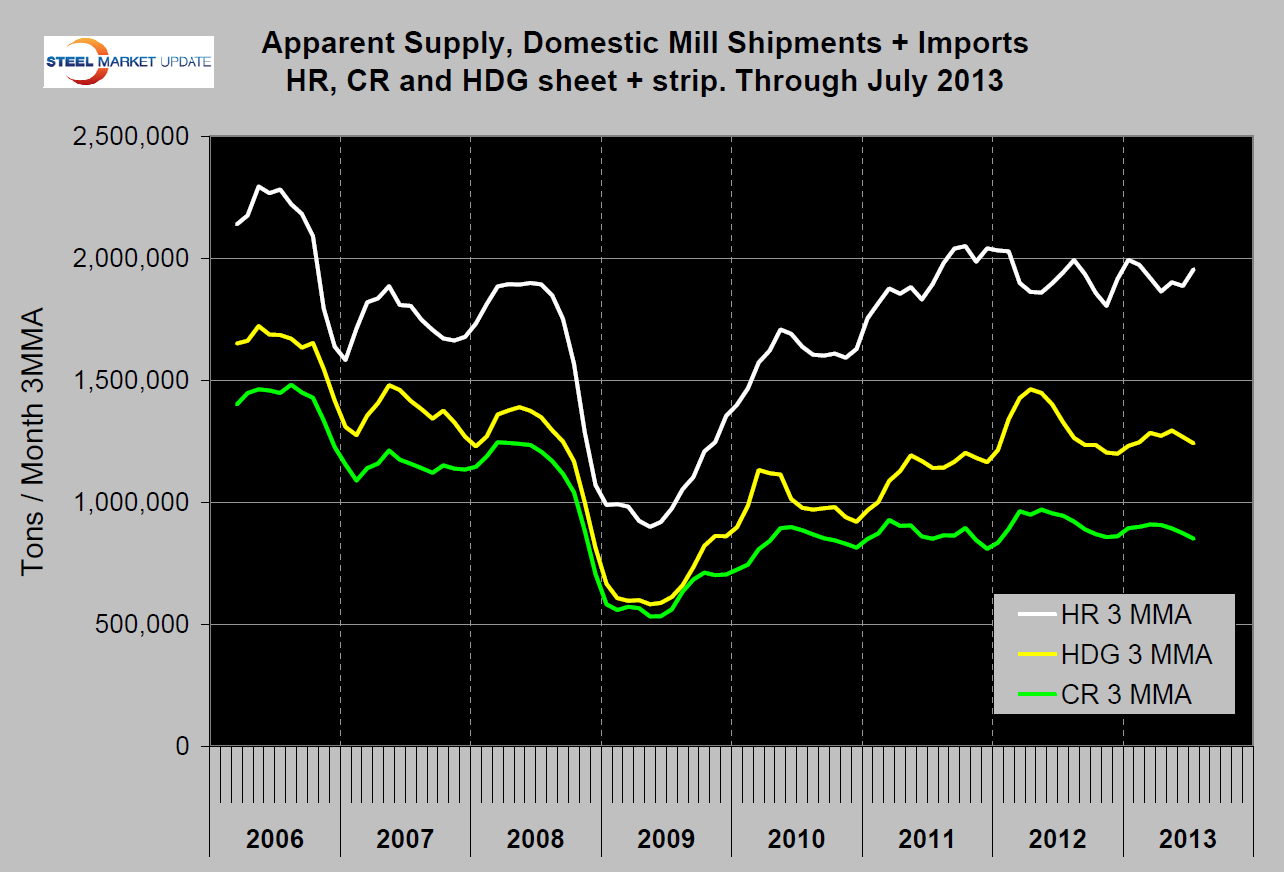

Figure 1 shows the long term supply picture for HR, CR and HDG since January 2006. Hot rolled has been breakeven but erratic for the last 16 months. Cold rolled has been drifting down for over a year. HDG had a strong bump in H1 2012, declined in H2 2012 and has been not much changed for over a year.