Market Data

September 19, 2013

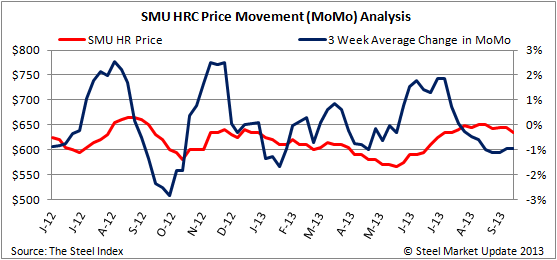

SMU MoMo Index Shows Little Change in Price Movement

Written by Brett Linton

The Steel Market Update Price MoMo Index for flat rolled steel in the U.S. turned negative this week after 15 consecutive weeks in positive territory. MoMo, a trailing indicator, is based upon the current hot rolled coil price weighed against the previous 12-week average spot price as recorded by Steel Market Update. MoMo was measured at -0.97 percent this week, down from 0.91 percent last week, meaning that the current HRC price is now below what it was 12 weeks ago.

The change in MoMo can be a useful indicator in depicting the severity of price movements. Looking at this change on a 3-week moving average, we see that the trend in HRC price movement fluctuation has begun to flatten out over the past 3 weeks. The 3-week average change in MoMo is -0.96 percent, a slight increase for the 3rd week in a row after 10 weeks of consecutive declines. The graph below demonstrates the relationship between the SMU hot rolled coil price and the three week moving average change in MoMo. Our HRC price range for this week is unchanged at $620- $650/ton with an average price of $635/ton.