Prices

September 22, 2013

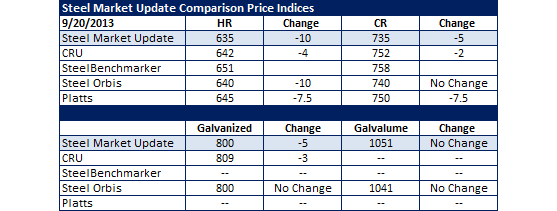

SMU Comparison Price Indices: Prices Falling

Written by Brett Linton

Prices this week are slightly lower over what we saw last week. For all of the companies below, prices fell or remained steady for all four products followed. We saw slight movement from $10 per ton lower or no change at all. Benchmark hot rolled prices range from $635 to $645 per ton (average $640.50 per ton). Note that Steel Benchmarker did not publish prices for last week, so their prices were excluded from the calculation above.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

SteelOrbis: Midwest Domestic Mill.

Platts: Within 200-300 mile radius of Northern Indiana Domestic Mill.