Prices

September 26, 2013

Total Steel Imports Up 13.9% in August

Written by John Packard

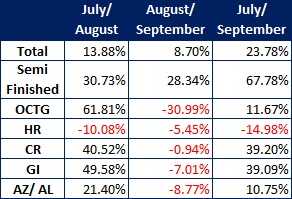

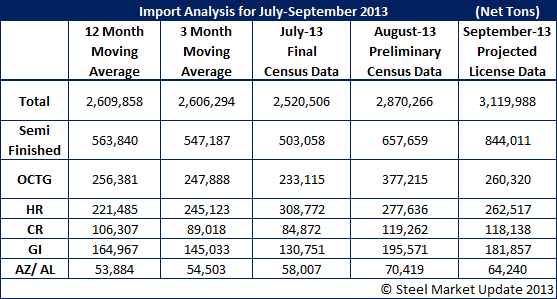

The headline you are seeing both here and in other trade publications is total steel imports are up 13.9 percent in August based on just released Preliminary Census Data from the U.S. Department of Commerce. Total imports rose from 2,520,506 net tons in July to 2,870,266 net tons in August.

When looking at flat rolled, we are seeing early signs of increases in cold rolled which was up 40.52 percent compared to July and is forecast to be up 39.20 percent in September based on our projections of preliminary license data. Most of the increase in cold rolled can be attributed to South Korea which shipped 5,632 tons in July and then increased to 27,132 tons during August. We are projecting Korea to drop down closer to their 14,000 ton average during September.

The other flat rolled product where we are seeing increases in tonnage is galvanized, up almost 50 percent in August over July and projected by SMU to be up just under 40 percent in September compared to July.

Galvalume (other metallic) imports in August were 21.40 percent higher than July and we expect September to be approximately 11 percent higher than July.

Hot rolled imports during the month of August were below July levels by 10 percent and our projection for September has hot rolled lower than July levels by approximately 15 percent.

The products creating the most volume in the import numbers are semi-finished (slabs and billets) which were up 31 percent in August over July and are forecast to be up 68 percent (note: July imports were below both the 3MMA and 12MMA). The increase is due to the Brazil shipments rising as they try to restock the ThyssenKrupp Steel USA Calvert, Alabama operation. SMU is forecasting semi-finished shipments to rise to 844,000 net tons during the month of September.

The other product where we are seeing large increases in tonnage is oil country tubular goods (OCTG) which increased by almost 62 percent in August. This was due to an increase of 1200 percent by Argentina which went from 8,091 tons in July to 105,848 tons in August. SMU is forecasting more normal tonnage levels for OCTG in the September import numbers.

Many in the flat rolled steel markets are expecting a “surge” in imports due to the spread between foreign pricing which SteelBenchmarker pegged at $573 per metric ton for hot rolled ($520 per net ton) fob port of export and $650 per metric ton on cold rolled ($590 per net ton) fob port of export.

So far, SMU is aware of some increases in tonnage on light gauge flat rolled products but not enough to consider a “surge” or of major concern for the domestic steel mills.