Market Data

October 2, 2013

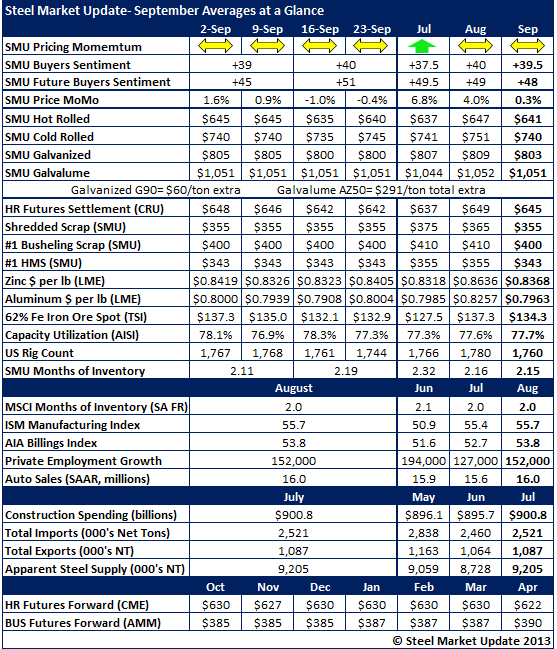

September Data at a Glance

Written by John Packard

September ended with the SMU Price Momentum Indicator pointing toward Neutral. In light of the price increase announcements beginning to come out of the domestic steel mills we will continue our Neutral position allowing all the mills to announce (or not) and buyers to react before making a change toward one direction or another.

SMU Steel Buyers Sentiment Index continued to be firmly set in the optimistic range of our index.

On the pricing front hot rolled, cold rolled, galvanized and Galvalume pricing we down slightly from the August monthly average. Benchmark hot rolled averaged $641 per ton based on our data collection. The CRU index settled the month at $645 per ton +$4 above our number.

Scrap prices were down approximately $10 per ton on most grades (Midwest). Zinc prices and aluminum prices remained relatively stable ending the month averaging $.03 per pound lower than August and in line with July. Iron ore spot pricing in China continues to be above $130 per dry metric ton which is much higher than many analysts had been predicting earlier this year.

Not showing on our table is our analysis of the MSCI data and our determination that the flat rolled carbon service centers are still running an inventory deficit of approximately 463,000 tons.