Prices

October 24, 2013

Iron Ore and Scrap Futures: Busheling Higher – Ore Softens

Written by Bradley Clark

TSI Iron Ore: Market Soften As Rebar Slides

Iron ore prices have been fairly volatile over the past week as conflicting data and information coming out of China as moved the needle in opposite directions. The upshot to all of this intraday volatility is that prices remain fairly unchanged on a week-on-week basis. With rebar prices softening in China overnight iron ore has followed suit down to close about 1.3 percent down from yesterday’s close. The Q1 still is trading around $124 and Q2 $118 and Q3 at $115. Volumes remain very strong with millions of tons trading this week.

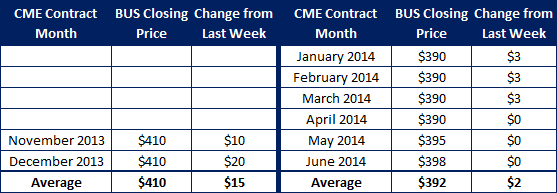

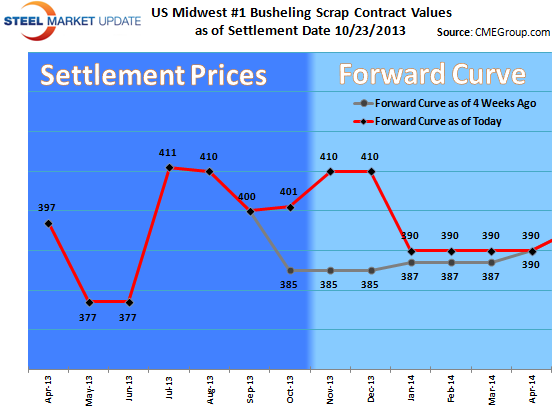

U.S. Midwest #1 Busheling Ferrous Scrap (AMM) Prices Rocket Up

The busheling futures market has shot up this week as it is becoming more evident that Midwest prime will be up $30-40 this month. After settling at $385 per ton the November and December futures contracts have been bid as high as $420 in the market as traders look to lock in prices before next month’s jump in pricing. While volumes remain low, the talk of a big move in the physical market has brought out several new market participants looking to trade the busheling futures contract. Hopefully a continued increase in volatility will help to spark more trading on this contract as it moves past its first year anniversary.

Again, there have been no reported trades this past week.