Overseas

November 10, 2013

World Hot Rolled Price Analysis vs. USA Pricing

Written by John Packard

In the last issue of SMU, the Final Thoughts article had information from the financial community with a Bloomberg graphic pointing out the difference between U.S. benchmark hot rolled coil prices and those from the rest of the world. The premise being the $190 spread recognized by the financial community was unsustainable. The net result inferred U.S. prices would have to attract foreign tons thus pressuring pricing.

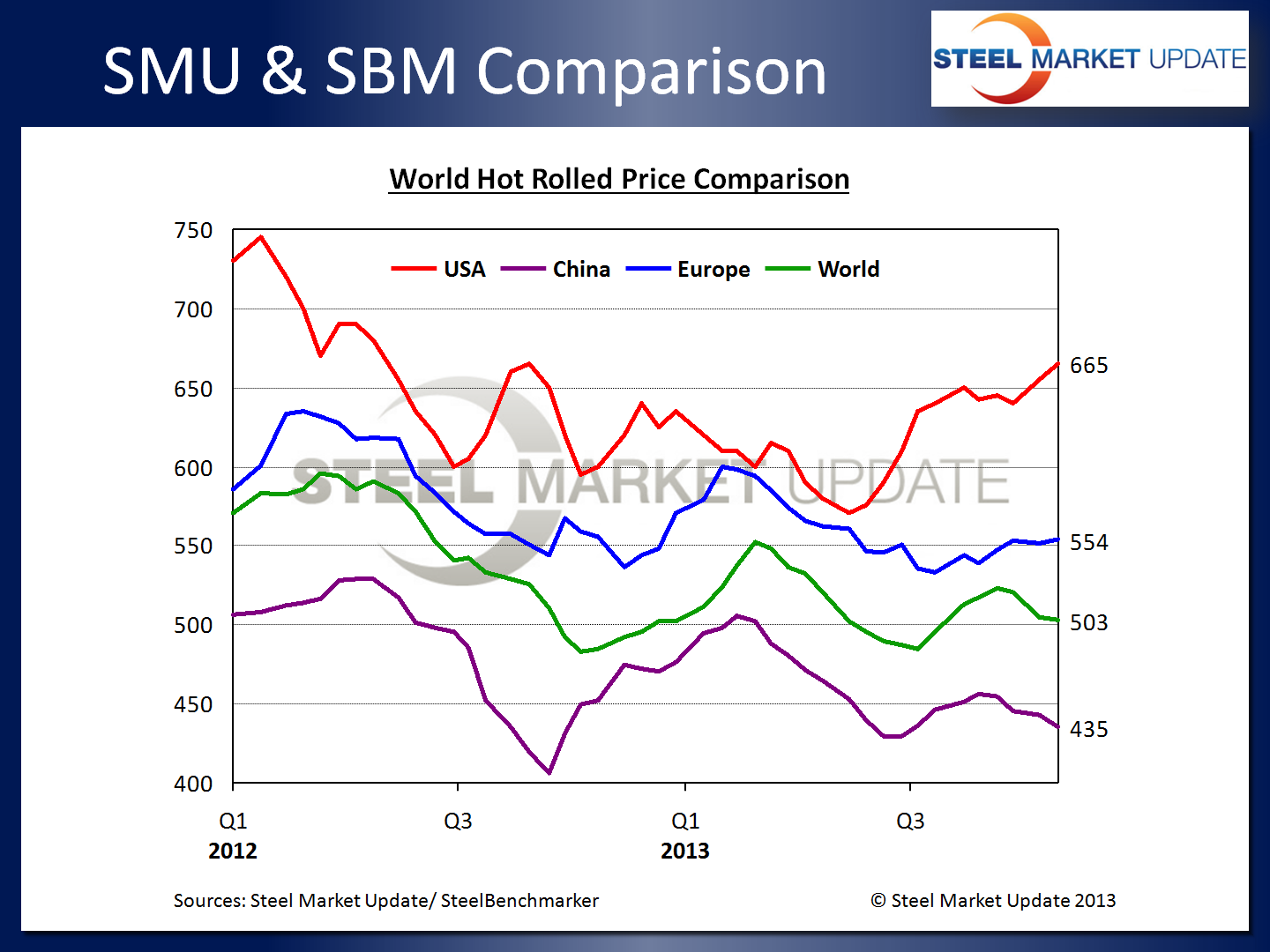

We received a number of comments and questions regarding the math associated with that article so we thought it wise to produce one of the graphs we keep internally within our company. In the graphic below we are using the SMU hot rolled average from the end of October and we are comparing it to SteelBenchmarker hot rolled coil indices in Europe (blue), China (purple) and the world export price (green). All price referenced are in net tons, not metric tons.

The China and Europe numbers are EX Works (FOB producing mill) and are for domestic market consumption. The green line, which is the world export price as determined by SteelBenchmarker, is $503 per net ton to which one would need to add freight, insurance, handling and a trader’s margin. Based on SteelBenchmarker there was a $162 per ton spread between world export pricing and the SMU hot rolled average at the end of October (our current number is $660).

If we add to the world export number reasonable freight costs of approximately $60 per ton, handling, insurance and trader profits which could be another $25 to $40 per ton the spread is dramatically reduced. This is why there have not been a “flood” of imports (yet) into the U.S.

Based on U.S. Department of Commerce license data, during September the number of imports of hot rolled coil totaled 278,589 net tons. This is approximately 70,000 tons above the 12 month moving average but below the 3 month moving average.

Our recent channel checks found hot rolled coil pricing into Gulf ports at $560 to $610 per ton which leaves a $50 to $100 per ton spread based on our most recent HRC index ($660). If the mills collect another $20 of the announced increases (which range from $700 to $710) and our index rises to $680 over the next 30 days the spread could widen to $70 to $120 per ton variance which would make foreign very attractive to those located close to port cities.

However, hot rolled is the low end product. The areas more likely to see more import action would be cold rolled and coated steels. We could see spreads jump to over $200 per ton on light gauge galvanized and at that level a buyer would have no choice but to consider going foreign for at least a portion of their business.

Foreign orders placed now would not arrive until late February and possibly as late as April 2014.