Prices

November 17, 2013

September Steel Imports Total 2.8 Million Tons

Written by John Packard

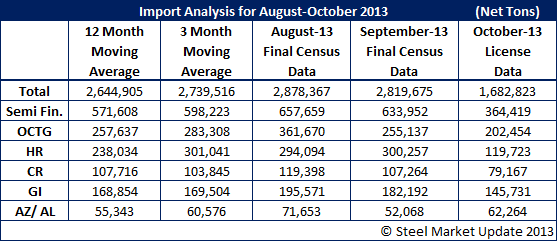

The U.S. Department of Commerce (DOC) released Final Census Data on steel imports for the month of September. Total imports (all products) were reported to be 2,818,675 net tons which is down slightly from the 2,878,367 net tons received during the month of August.

Compared to last September (2012) there were 215,624 more tons received during September 2013 than last year.

October imports are forecast to be 1,682,822 net tons. However, the DOC reported that they did not collect license data from October 1st through October 16th. According to the DOC website the September and October license data are incomplete.

The most noticeable reduction in tonnage was oil country tubular goods (OCTG) which dropped 106,532 net tons from August to September.

We also saw reductions in semi-finished (mostly slabs) which fell 21,507 net tons in September compared to August.

Hot rolled coils recorded their largest month compared to the past 12 months have received 300,257 net tons in September. This is up 6,163 tons over August totals for the product.

Cold rolled coils were slightly lower in September than August as the U.S. imported 107,263 net tons.

Galvanized coil imports totaled 182,246 net tons in September which is down 13,324 net tons from the 195,570 net tons received in August.

Other metallic (mostly Galvalume) imports totaled 52,067 net tons during September, down from the 71,653 net tons received in August.

Also of note were plates in cut lengths and coils, both of which saw import increases during the month of September. Combined the two accounted for 216,371 net tons which is up from the 149,483 net tons reported during the month of August.

Based on license data collected through the 14th of November, the month is projected to come in around 2.9 million net tons. If that ends up being correct, it will be the highest total in the past 12 months and the largest amount of steel imports since May 2012.