Prices

January 28, 2014

January Imports Now Projected at 3.0 Million Tons

Written by John Packard

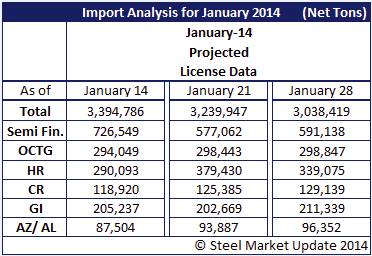

David Phelps warned our readers not to put too much stock in the U.S. Department of Commerce license data, which he felt could be very misleading. Our initial forecast for January steel imports produced through the aid of the import license data from the 14th and again on the 21st of January indicated a possible surge of imports to about 3.2 million net tons.

With the latest license data just released today (January 28) our total steel forecast is not barely breaking 3.0 million tons. The 3 million ton number is still a big number but 10 percent lower than what the numbers “suggested” earlier this month.

We will not know what the actual Census Data is until sometime in March. At the moment the most recent Census Data is for the month of November when 2,592,549 net tons were exported to the United States.

We now have Preliminary Census Data for December with the revised number being 2,502,044 net tons. The December license data suggested the month would be closer to 2,582,436 net tons or 80,000 net tons more than what the Preliminary Census Data is suggesting.

The table below is the three forecasts for the month of January based on license data provided by the U.S. Department of Commerce. When reviewing the key items followed by Steel Market Update we find a large variance in semi-finished which appears will be closer to the 605,827 net tons in December.

Oil Country Tubular Goods (OCTG) have remained fairly constant throughout the month.

Hot rolled imports, once forecast to come close to 400,000 net tons, are now suggested at a still high 339,075 tons.

Cold rolled has remained relatively constant throughout the month.

Galvanized numbers have grown slightly as the month progressed and the Galvalume numbers are still about double their average.