Analysis

February 20, 2014

January NAFTA Automotive Production and Sales

Written by Peter Wright

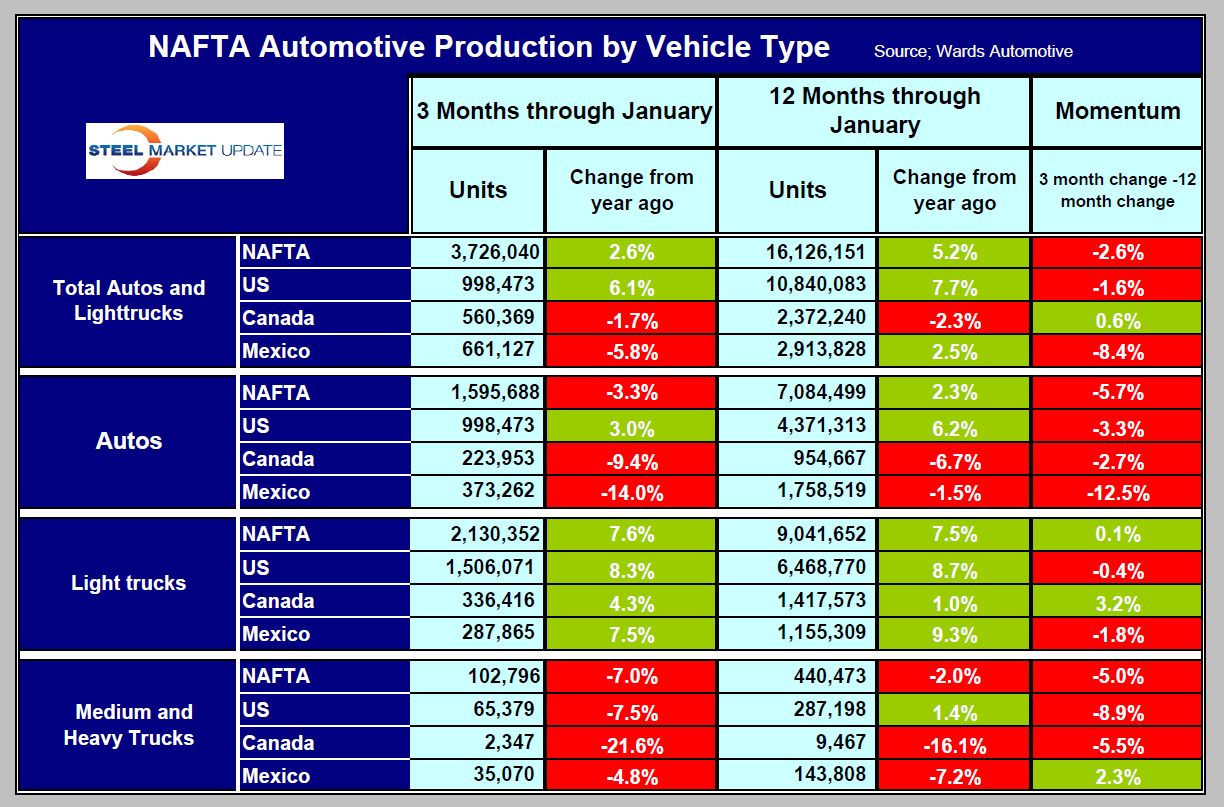

In 12 months through January 16,126,151 light vehicles and 440,473 medium and heavy trucks were assembled in the NAFTA. On a rolling 12 month basis year over year (y/y) light vehicle assemblies were up by 5.2 percent. In 3 months through January y/y the increase was 2.6 percent. Momentum is negative since the short term gain is less than the long term which means that production is slowing. In 3 months through January y/y the US was the only country to have positive growth in light vehicle assemblies at 6.1 percent. Canada and Mexico contracted at 1.7 percent and 5.8 percent respectively.

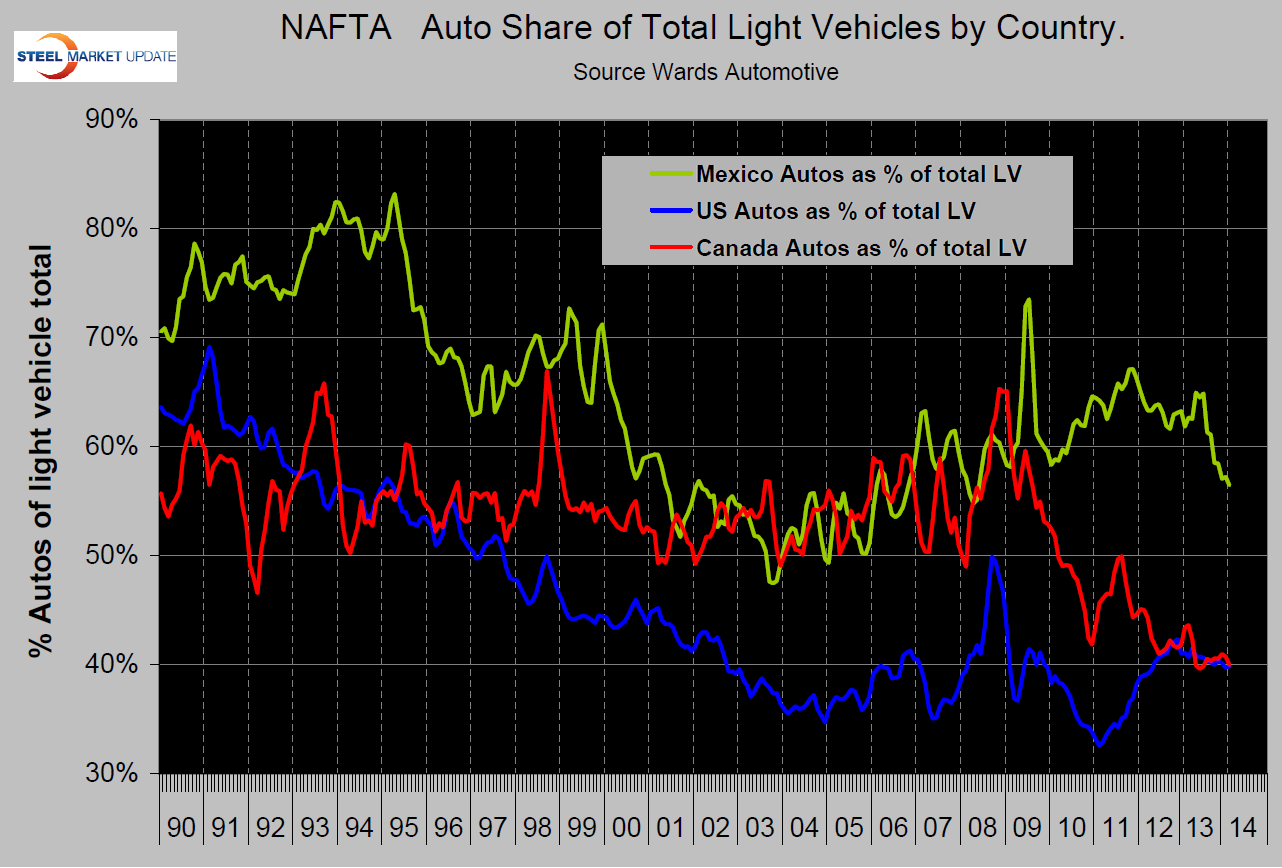

The mix of light vehicle production in Mexico is quite different from the US and Canada though Mexico has changed substantially since April last year. The proportion of autos in the total light vehicle mix in the US and Canada is 40 percent, the balance being light trucks which includes crossovers. In Mexico the Auto proportion is currently 56.5 percent, down from 65.0 percent in the last nine months (Figure 1). There has been a major shift towards light trucks in the US since the pre-recession time frame.

The mix of light vehicle production in Mexico is quite different from the US and Canada though Mexico has changed substantially since April last year. The proportion of autos in the total light vehicle mix in the US and Canada is 40 percent, the balance being light trucks which includes crossovers. In Mexico the Auto proportion is currently 56.5 percent, down from 65.0 percent in the last nine months (Figure 1). There has been a major shift towards light trucks in the US since the pre-recession time frame.

The assembly situation for medium and heavy trucks is worse than for light vehicles. On a 12 month basis y/y growth was a negative 2.0 percent and on a 3 month basis was negative 7.0 percent. Again momentum is negative and production is slowing. All regions had negative growth of medium and heavy truck assemblies in 3 months y/y and only the US had positive growth in 12 months y/y (Table 1).

Moody’s Economy.com made the following observations about US vehicle sales. Vehicle sales in the US began relatively slowly in 2014. On a seasonally adjusted annualized basis, automakers reported sales of 15.2 million units, down from the total for January 2013 as well as the average for all of 2013. However, severe winter weather is to blame, and sales that were delayed during the past two months will be made up in coming months.

Economic fundamentals for the vehicle industry are still positive, especially as the economy is expected to gain momentum throughout 2014. Accelerating employment and income growth, an improving housing market, and a rebound in nonresidential investment will drive sales. Vehicle-specific drivers such as low interest rates, increased leasing, and expanded access to credit will also foster sales. Vehicle manufacturers have also been pumping up incentive spending and launching new vehicles in recent months. In addition, as an estimated 3 million vehicles come off lease, households and businesses will seek to replace their vehicles. Finally, pent-up demand will remain a key driver of sales. Moody’s Analytics expects sales to grow throughout the year and average 16.7 million units for the year. In 2015, sales will weaken only slightly but will come down to a more sustainable pace close to 15.5 million units through the end of the decade.

This optimistic outlook is not without risk. The possibility of a more rapid increase in interest rates than currently expected now that the Fed has begun to wind down its asset-purchase program would dampen sales. Higher interest rates would not only increase the cost of purchasing vehicles but would have broader effects on the economy. In addition if the labor market fails to gain momentum as expected, vehicle sales for this year would disappoint.

In addition, the recent weakness has increased inventories for manufacturers, from 114 days for GM to 105 for Chrysler at the end of January. This could lead to lower production (Ford is already cutting production) and to higher incentive spending. While incentives are good for consumers, they erode industry profits. (Sources: Wards Automotive and Economy.com)