Market Data

April 2, 2014

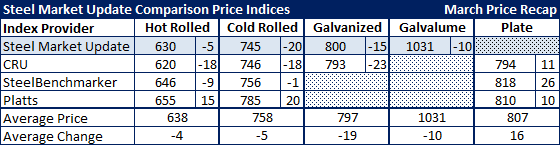

March SMU Comparison Price Indices: All Lower Except One

Written by John Packard

Every month we track a number of the other steel indexes including the two used the most for contract adjustments: CRU and Platts. We had some interesting results as the month of March closed as all of the indices showed declines (compared to the end of the prior month) in hot rolled, cold rolled, galvanized and Galvalume steel pricing. The only exception being Platts which was pretty consistent with their higher priced outlook as the month progressed and especially immediately after the announced price increases during the week of March 17th.

As you can see there is quite a spread between the various indexes on benchmark hot rolled. As the month closed CRU was at $620 (which is where SMU was the week before), SMU closed the month at $630, SteelBenchmarker $646 and Platts at $655 per ton.

Plate prices rose during the month – and all the indexes agreed on that one product…