Prices

April 22, 2014

April Imported Steel Projection Still Above 3.5 Million Tons

Written by John Packard

Foreign steel imports, for the month of April 2014 are projected by Steel Market Update to exceed 3.5 million net tons. Based on preliminary license data collected by the U.S. Department of Commerce through April 22, 2014 imports could reach as high as 3.7 million net tons. However, as our regular readers already know, license data can be quite suspect and the final numbers could vary by a few hundred thousand tons.

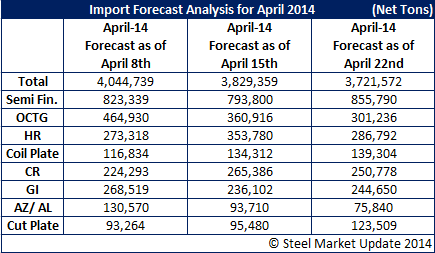

This is our third projection for the month of April, all based on US DOC license data. We started doing these projections to provide a trend line for our readers and a way of keeping a history as to how accurate the license data actually is from week to week. As you can see from the table below, the projection (which we call a forecast in the table) has been moving lower each week. When SMU made our first projection it was for imports to reach 3.5 million net tons.

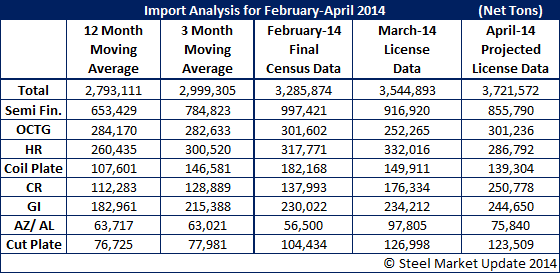

In the second table shown below, we are showing our readers what the 12 month and 3 month moving averages are, what the February final census data was (3.2 million net tons) and the March projection based on license data through April 22nd (3.5 million net tons) as well as the projected tonnage for April (3.7 million tons). We anticipate the final April number will be somewhere between 3.5 and 3.6 million net tons when the dust has cleared.

We should get final census data for the month of March a little later this week.

As you can see by the table, it appears imports of OCTG (oil country tubular goods), cold rolled and galvanized will exceed the prior month. When looking at each product from a 12MMA, basis slabs will be higher, OCTG, HR, coiled plate, cold rolled, galvanized, Galvalume and cut plate will all exceed the 12 month moving average.