Prices

May 27, 2014

May Imports Forecast to Roll Over April

Written by John Packard

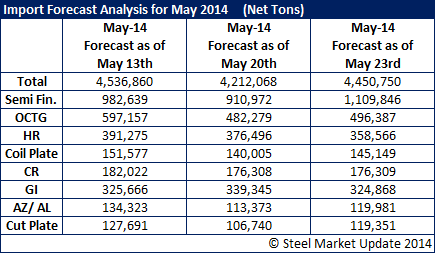

The numbers are not looking good for the domestic steel mills as the latest license data from the US Department of Commerce shows May steel imports may well exceed the 3.7 million tons just reported for the month of April (Preliminary Census data for April). We remind our readers that the May tonnage shown in the table below is based on license data which should only be used as an indicator of where we think the final number will be.

Based on past experience and the latest license data, Steel Market Update believes the month of May will see steel imports break 4.0 million net tons.

At the moment, the license data is (and has been since the beginning of the month) suggesting we could see imports hitting 4.2 to 4.4 million net tons.

Semi-finished import license data is suggesting we could see a second month in a row over 900,000 net tons of slabs/billets (mostly slab).

The one item which looks scary at the moment and may prompt even louder cries to the government to slap dumping duties on South Korea and others, is Oil Country Tubular Goods (OCTG) which hit 272,139 tons during April have been consistently suggesting 400,000+ net tons during May. During April, we saw one week (second week of April) which had OCTG at the 400,000 net ton level before tailing off. By the 22nd of April, license data was suggesting the April number on OCTG would be 301,000 net tons, slightly above the 272,139 ton number just reported in the April Preliminary Census data. As of the 23rd of May, license data is suggesting OCTG at 496,387 tons net tons (ouch!). SMU expects the number to be closer to 400,000 net tons (still ouch!)….

OK, we lied. All of the numbers look scary (see table below).