Market Data

June 1, 2014

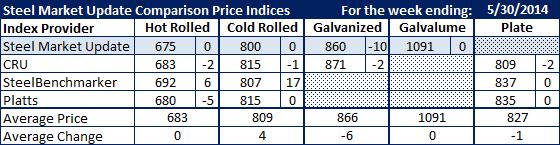

SMU Comparison Price Indices: Stable to Down Slightly

Written by John Packard

With the exception of SteelBenchmarker which only supplies steel indices twice per month, all of the other indexes showed flat rolled steel averages as being either the same or down slightly compared to one week ago. Perhaps the most surprising has been Platts which by the end of this past week had taken its benchmark hot rolled number down to $680 and is now the second lowest HRC average (SMU is at $675).

Cold rolled prices continue to average $800 per ton or higher. Galvanized averages were lower on both the CRU and SMU indices. Galvalume remained the same. The plate average dropped $1 per ton to $827 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.