Prices

June 18, 2014

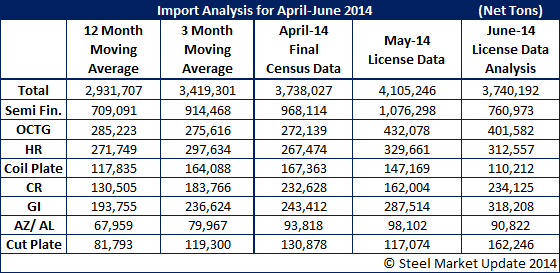

June Import License Data Continues to Point to 3.5+ Million Tons

Written by John Packard

Based on the most recent import license data produced by the U.S. Department of Commerce, imports continue to be on pace to meet, or exceed, 3.5 million net tons. This would be the 3rd month in a row where foreign steel imports were at 3.5 million tons or above.

Since the beginning of the year we have seen foreign steel imports (all products) at, or above, 3.2 million net tons each and every month. If this trend were to continue and the U.S. averages 3.2 million net tons of imports during this calendar year, we would reach 42 million net tons for the year. An extremely high number especially when considering the economy compared to 2006 when we reached 39 million net tons.

Semi-finished imports appear will be lower than the 900,000 to 1 million net tons we saw over the past couple of months. It looks like most of the adjustment from the May 4 million net ton level down to slightly lower import levels in June will be due to lower semi-finished (fewer slabs going to the steel mills).

Oil country tubular goods (OCTG), which we have written about on a number of occasions in the past week, continue to look like they will be well in excess of both their 12 month and 3 month moving averages. We will need to wait until later this month to see if the license data continues at the 400,000 net ton pace or, if the numbers will fizzle a bit as the month progresses.

As you can see by the table below, the items where our analysis of the license data suggests June import levels will exceed their 12MMA and 3MMA are: hot rolled, cold rolled, galvanized, Galvalume and cut plate.