Prices

August 19, 2014

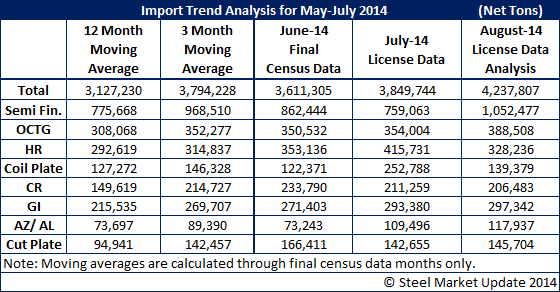

August Imports Still Trending Toward Exceeding May Levels

Written by John Packard

Steel Market Update (SMU) analyzes foreign steel import license data on a weekly basis. From the data we can see where import tonnages are trending although we are not comfortable calling a specific number as the license data can be suspect until after the month is over. For the second week August license data is suggesting total steel imports could well exceed the May 4.0 million net ton level.

As always, the domestic steel mills continue to be the largest importers of foreign steel. Semi-finished steels are trending toward a 1 million net ton mark for the month. If this rate holds, slab imports will exceed both June and July levels as well as our 12 month moving average and 3 month moving average. Russia and Brazil are the two major importers with Mexico third.

The domestic mills also import hot rolled coil (USS/Posco, Steelscape and CSN) to be converted to cold rolled and coated products. Hot rolled imports appear to be within the 12 month and 3 month moving averages and below the July 2014 import levels. The countries exporting more than 20,000 net tons are: South Korea, Canada, Australia, Turkey, Japan, and Russia.

Cold rolled imports continue to be trending toward similar levels as June and July (approximately 200,000 net tons). China continues to be the major supplier by far.

Galvanized imports are also trending toward the June and July levels which are in the upper $200’s net tons. China is the largest supplier followed by South Korea, Canada, India and Taiwan (each exceeding 20,000 net tons).

Galvalume is the one item which continues to trend higher than June and July levels and is looking like AZ could exceed 110,000 net tons. Taiwan is the major exporter of Galvalume to the U.S. in August based on the license data reviewed by SMU through August 19, 2014.

OCTG continues to trend in the upper 300’s of tons or about the same levels as seen in June and July. The largest exporting country continues to be South Korea by a wide margin with almost half of the total OCTG import licenses.