Prices

August 19, 2014

Hot Rolled, Cold Rolled, Galvanized and Galvalume Apparent Steel Supply Growth

Written by John Packard

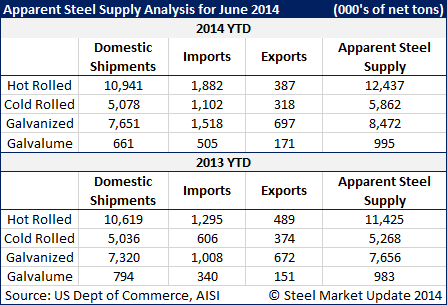

Steel Market Update (SMU) has been looking at the growth of each flat rolled product during the first six months 2014 vs. the first six months 2013. What we found is how foreign steel has been usurping much of the apparent steel supply growth from the U.S. steel mills.

Hot rolled shipments out of the domestic steel mills rose by 3 percent during the first six months 2014. However, when viewed by apparent hot rolled supply we found supply rose by 8.2 percent. The difference was the amount of foreign steel which arrived during the first six months 2014. The increase in HRC was 587,000 net tons (31.2 percent). At the same time the U.S. steel mills exported fewer hot rolled tons (-102,000 net tons).

Domestic cold rolled shipments increased during the first six months 2014 by less than 1 percent. However, when looking at apparent cold rolled supply we found the CRC market grew by 11.2 percent. Foreign cold rolled imports grew by 45 percent.

Galvanized domestic shipments increased by 4.4 percent during the first six months 2014. As a product, galvanized apparent supply grew by 9.7 percent. Foreign imports grew by 43.6 percent during the first six months 2014.

The domestic steel mills shipped 661,000 tons of Galvalume during the first six months 2014. This was actually a reduction in tons compared to the first six months 2013 when 794,000 tons were shipped by the domestic steel mills. AZ apparent supply grew in 2014 even though domestic shipments were lower. Apparent supply of AZ grew by 1.2 percent. Foreign steel imports grew by 32.7 percent.