Analysis

August 26, 2014

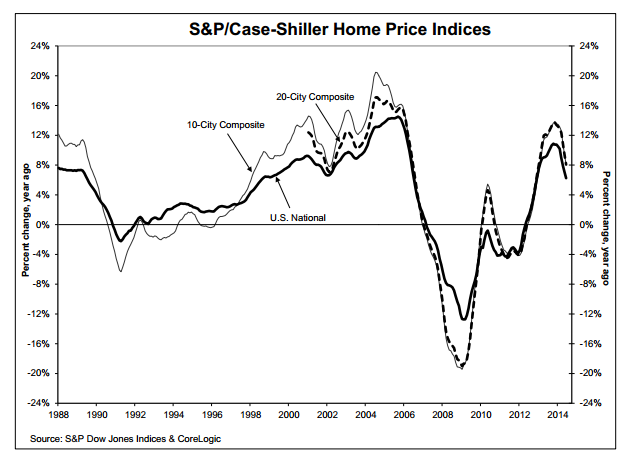

S&P/Case-Shiller Reports Slowing Price Gains

Written by Sandy Williams

Home price gains slowed in June according to the S&P/Case-Shiller Home Price Indices. The monthly national index increased just 0.9 percent in June and the 10-City and 20-City Composites increased 1.0 percent. The index shows a sustained slowdown in the 12 months ending June 2014.

“The monthly National Index rose 0.9% in June. While all 20 cities saw higher home prices over the last 12 months, all experienced slower gains. In San Francisco, the pace of price increases halved since late last summer. The Sun Belt cities – Las Vegas, Phoenix, Miami and Tampa – all remain a third or more below their peak prices set almost a decade ago.

“Bargain basement mortgage rates won’t continue forever; recent improvements in the labor markets and comments from Fed chair Janet Yellen and others hint that interest rates could rise as soon as the first quarter of 2015. Rising mortgage rates won’t send housing into a tailspin, but will further dampen price gains.”