Prices

October 23, 2014

Rumors Pushing What History Says is Probable: Fall Price Increase

Written by John Packard

Steel Market Update is hearing the rumors about the potential for a new flat rolled steel price increase. The rumors are mostly coming from the service center and financial community. But, our readers, if paying attention, should not be surprised by the rumors and the real possibility that the mills will attempt to cut their losses and reverse course by announcing a price increase.

From our perspective, and those of you who follow our mill negotiations and pricing data on our website, we expect that sometime within the next couple of weeks there will be an attempt to raise prices. This is what happens virtually every year.

From a historical perspective, going back and looking at the last four years, we found in each year the domestic mills announced a price increase on flat rolled by the first week of November. In 2010 the first increase was announced on November 1st. When we got to 2011 the increase was announced on November 2nd. In 2012 the announcement was made on October 16th and then in 2013 the first increase was announced on the last day of September.

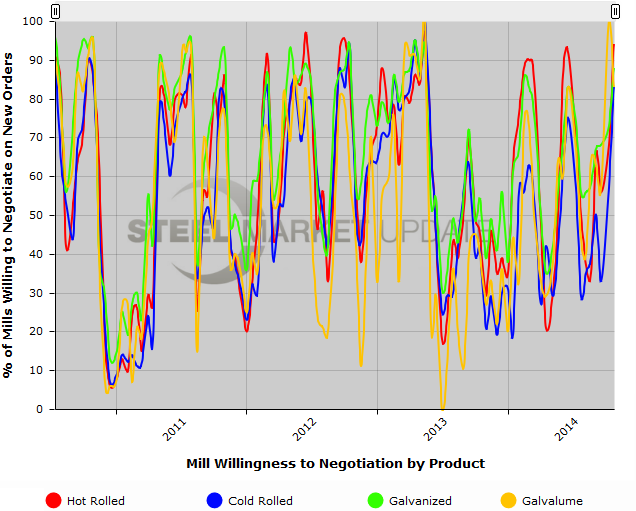

Since we just published our SMU Mill Negotiations chart, we thought it would be interesting to see if there are any correlations to where we are now and what we have seen in the past.

In Fall 2010 we saw mill negotiations peak on October 1, 2010 with hot rolled at 71 percent, cold rolled 74 percent, galvanized 82 percent and Galvalume 95 percent.

When we got to the Fall 2011 hot rolled peaked on November 1, 2011 at 75 percent, cold rolled 77 percent, galvanized 85 percent and Galvalume 91 percent.

The Fall 2012 saw negotiations peak on October 1, 2012 with hot rolled at 78 percent, cold rolled 83 percent, galvanized 88 percent and Galvalume 95 percent.

Last year negotiations peaked on September 15th with hot rolled at 40 percent, cold rolled 63 percent, galvanized 70 percent and Galvalume 72 percent.

All of this data is available on the SMU website to all members and our free trials. The graphic below is a snapshot of what is available to you when you are logged into the website. You can access the interactive data on lead times and negotiations under the Analysis tab. When you are on the website you can hover over the graph with your mouse and the data will be displayed for each product.