Prices

December 14, 2014

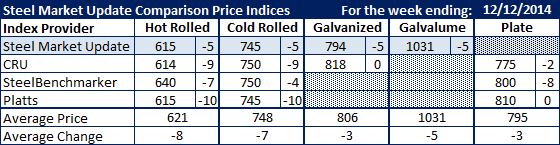

Comparison Price Indices: Pace of Decline Increasing?

Written by John Packard

All of the flat rolled steel price indices followed by Steel Market Update moved lower this past week. Based on performance and their ability to keep up with the markets, the three key indices are SMU, CRU and Platts which reported benchmark hot rolled price averages as $615, $614 and $615 per ton, respectively. SteelBenchmarker did report prices last week and their $640 hot rolled number is outside the upper range being reported by the other indices.

Cold rolled prices had all of the indices reporting numbers from $745 to $750 per ton average.

Galvanized pricing saw CRU holding their $818 per ton number on .060” G90 which is the benchmark product being used in both indices. SMU dropped our galvanized average by $5 per ton.

Galvalume prices also saw a $5 per ton drop on .0142” AZ50 Grade 80 which is the item used for price comparison purposes.

Plate prices saw a wide range from CRU $775 per ton to Platts $810 per ton.

Steel Market Update Price Momentum Indicator continues to point toward lower prices over the next 30 days as the combination of short lead times, high imports, building inventories at service centers and too much supply for current demand levels are putting pressure on prices.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.