Market Data

January 25, 2015

Overcapacity Sinking Baltic Index

Written by Sandy Williams

Ship owners are reporting “staggering losses” says the January 15 MID-SHIP Report.

“Dry cargo freight rates are basically in “free fall” because of very low bunker costs coupled with major over supply of ships thus forcing freight levels down to where they were in 1982-1986,” according to MID-SHIP.

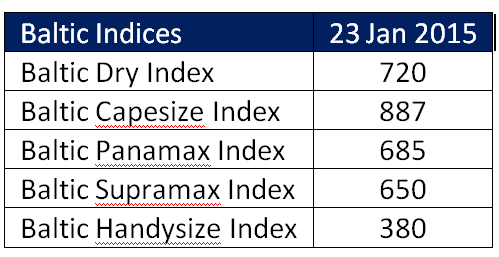

The Baltic Indices all registered declines in the week ending January 23. The Capesize Index ended an upwards trend after climbing 351 points early in the week before falling a total of 84 points on Thursday and Friday.

Andersen said he expects a continuing gradual decline in freight rates over the coming years. He predicts global trade will grow at a “sluggish” 4 percent in 2015.

In the U.S., logistic problems are beginning to surface due to winter conditions. Ice is reported on the Great Lakes and tributaries as well as on northern barge routes. Ice on the Illinois River has slowed transit times. Strong steel import activity is still noted at breakbulk terminals along the Mississippi River. Steel import activity is expected to increase during first quarter, says MID-SHIP.

West Coast ports continue to be congested due to logistic problems and the ongoing ILWU/PMA contract negotiations.

In the trucking industry, freight volume was strong in December with higher spot freight rates. Freight availability jumped 51 percent from the beginning to mid-January while spot truck capacity surged to 69 percent, said MID-SHIP. The combination, along with lower diesel fuel costs, has put downward pressure on freight rates. Average national price of diesel fuel was 2.933/gallon as of January 19, 2015.