Sheet

March 17, 2024

Martin on logistics: What’s driving flatbed rates

Written by Robert Martin

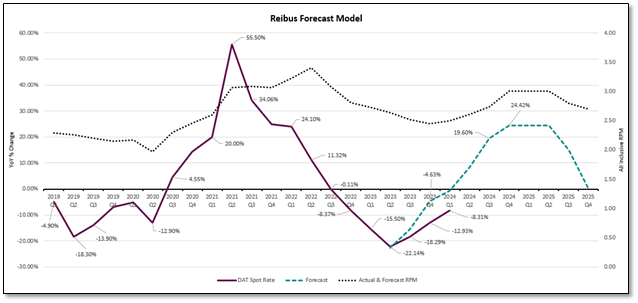

The spot rate trend in the flatbeds has seen a positive upturn. There are potential rate accelerators and decelerators, however, likely to influence spot and contract flatbed rates.

The flatbed market for spot rates is showing signs of improvement as we move through the new year. February increased slightly from January, marking the third consecutive month of upward movement.

This positive momentum comes as a welcomed shift for carriers, following a challenging 17 consecutive months marked by decreasing flatbed spot prices.

Potential accelerators

- Several factors could contribute to the current upward trajectory in spot rates. Keep an eye on the following potential accelerators:

- Increase in Diesel Prices: Fluctuations in diesel prices can directly impact spot rates.

- Increased Carrier Exits: As carriers exit the market, supply and demand dynamics can influence rates.

- Disruptive Weather Events: Unforeseen weather events may lead to supply chain disruptions, affecting spot rates.

- Supply Chain Disruptions: Any disruptions in the supply chain can have a direct impact on flatbed spot rates.

- Loosening of US Fiscal and Monetary Policy: Changes in fiscal and monetary policies can influence overall economic conditions, affecting the flatbed market.

Potential decelerators

- While the outlook is positive, it’s essential to be aware of potential decelerators that could impact spot rates:

- Economic Headwinds: Adverse economic conditions can act as a decelerator in the flatbed market as businesses become reluctant to invest capital in new projects during times of uncertainty.

- Interest Rates: Interest rates may stay higher for longer, which could have a cooling effect on the economy.

- Lower Diesel Prices: A decline in diesel prices would lead to lower rates in general and has the potential to keep more supply in the marketplace due to lower overhead expenditures.

- Slower Carrier Exits: A slower rate of carriers exiting the market may stabilize supply and demand dynamics.

- Geopolitical Factors: Global events and geopolitical shifts can introduce uncertainties that may affect the flatbed market.

March Rundown

- Global shipping challenges: In a missile attack on True Confidence on March 6, the bulk steel carrier was hit by a missile 50 nautical miles southwest of Aden, resulting in a fire. Tragically, three lives were lost in the first known casualties since Houthi Rebels initiated attacks in the Red Sea in late November. These incidents have led to increased transit times from China to Europe and the US East Coast.

- Cass freight index update: There are mixed trends in shipments and expenditures. The cass freight index reports a 7.3% month-on-month (m/m) increase in shipments but a 4.5% decline year-on-year (y/y). While the index remains soft overall, Q1 has shown improvement in underlying volumes, with a projected 3% sequential rise from Q4. Freight expenditures rose 4% m/m but fell 20% on a y/y basis.

- Class 8 truck orders: Normalization has followed a recent peak ftr’s report on class 8 preliminary net orders for January, revealing a decrease of 9% from December but an 11% y/y increase. After reaching a peak in November, Class 8 orders have stabilized around the estimated replacement rate of approximately 25,000 units per month.

- Consumer Price Index (CPI): Higher-than-expected inflation in caused February’s CPI to come in higher than projected, with a 0.3% monthly increase and a 3.1% annual gain, surpassing economists’ forecasts of a 0.2% monthly increase and a 2.9% annual gain. This unexpected uptick may impact the likelihood of the Federal Reserve cutting rates in the early part of the year, contrary to earlier expectations.

Stay tuned for more updates on the dynamic landscape of the shipping and logistics industry. For further details or inquiries, feel free to reach out to us.

Editor’s note: This is an opinion column. The views in this article are those of an experienced supply chain professional on issues of relevance to the current steel market. They do not necessarily reflect those of SMU. We welcome you to share your thoughts as well at info@steelmarketupdate.com.