Prices

February 5, 2015

Flat, Long, and Semi-Finished Imports through January 2015

Written by Peter Wright

Licensed data for January was updated on February 3rd through the Steel Import Monitoring System of the US Commerce Department. The SMU publishes several import reports ranging from this very early look using licensed data to the very detailed analysis of final volumes by district of entry and source nation which is published in our premium product.

The early look, the latest of which you are reading now, has been based on three month moving averages (3MMA) using January licensed data, December preliminary and November final data. We recognize that the license data is subject to revisions but believe that by combining it with earlier months data in this way gives a reasonably accurate assessment of volume trends by product as early as possible. The main issue with the license data is the month in which the tonnage arrives. We are currently investigating the relationship between licensed tonnage and month of arrival and will publish our summary of the accuracy of license data for the whole of 2014 in this newsletter next week. Total rolled product licensed imports in the month of January were 2,759,995 short tons which was over 800,000 tons higher than January last year but down by 52,000 tons from December.

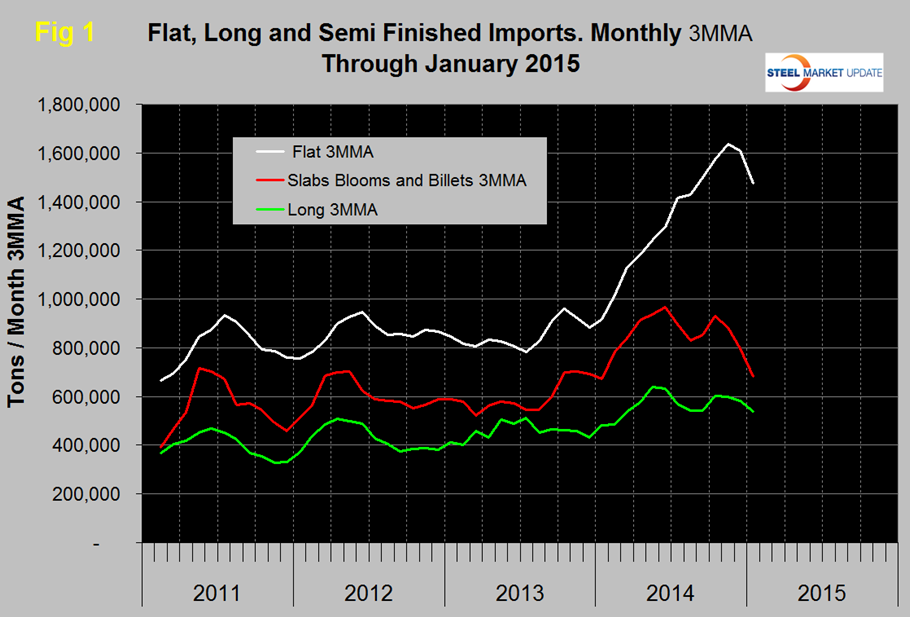

Figure 1 shows the 3MMA through January licenses for semi-finished, flat and long products. Flat includes all hot and cold rolled sheet and strip plus all coated sheet products including tin-plate plus both discrete and coiled plate. The import surge took a breather for flat rolled in December and the downward trend accelerated in January. Semi-finished began to decline in November and the downward trend also accelerated through January. Long products have declined since October though more slowly.

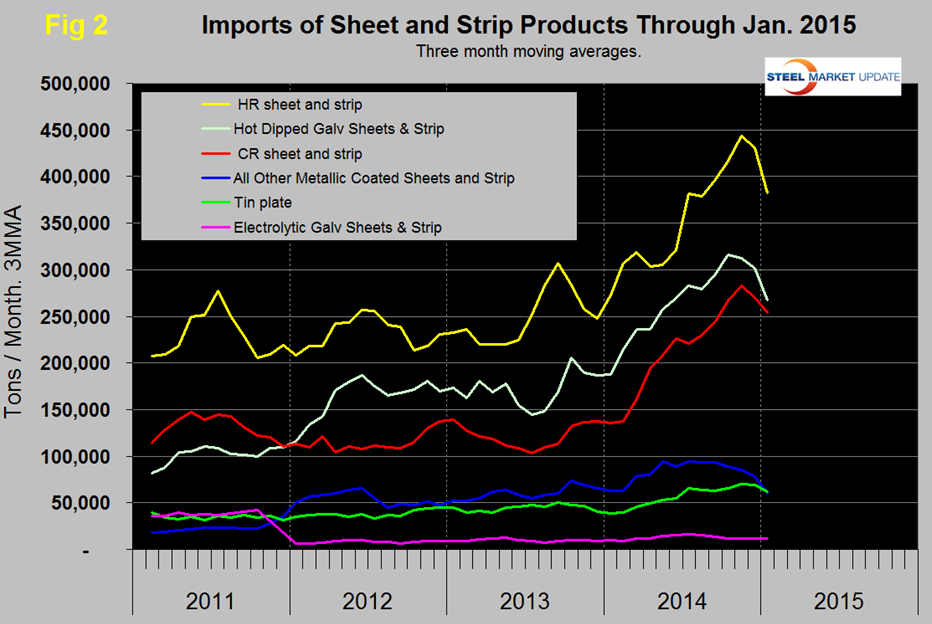

Figure 2 shows the trend of sheet and strip products since January 2011 as three month moving averages. The big three tonnage items, HR, CR and HDG all declined in both December and January. All other metallic coated, (mainly galvalume), has been declining since mid-2014 with an accelerating trend. Tin plate had been trending up for all of 2014 but declined in January. Electro-galvanized keeps on rolling along with little change in three years. In the single month of January hot rolled sheet and strip licenses were 367,193 tons, down 2.5 percent, HDG was 241,109 tons down by 15.7 percent and cold rolled came in at 246,302 tons, down by 2.2 percent.

Table 1 provides an analysis by major product group and by sheet products in detail and compares the average monthly tonnage in the latest three months through January with both the same period last year (y/y) and with three months through October (3M/3M). Semi-finished slabs and billets were down by 26.7 percent 3M/3M and up by 1.4 percent y/y. The total tonnage of hot worked products averaged 2,798,155 tons per month in three months through January, up by 40.4 percent y/y but down by 5.0 percent on a 3M/3M basis. On the same basis total hot worked products were up by 40.4 percent and down by 5.0 percent, flat rolled products were up by 61.1 percent and down by 6.2 percent, plate was up by 120.7 percent and up by 8.4 percent and long products were up by 12.0 percent and down by 10.4 percent. Table 1 shows the tonnage and percent change for sheet products in detail for which the average monthly tonnage in three months through January increased by 329,766 tons or 45.4 percent year over year. On a 3M/3M basis total, sheet products were down by 11.0 percent and all individual products were down, ranging from other metallic coated by 31.5 percent to electro-galvanized down by 3.9 percent.