Market Data

April 23, 2015

Steel Mill Negotiations: Stuck & Looking For a Way Out

Written by John Packard

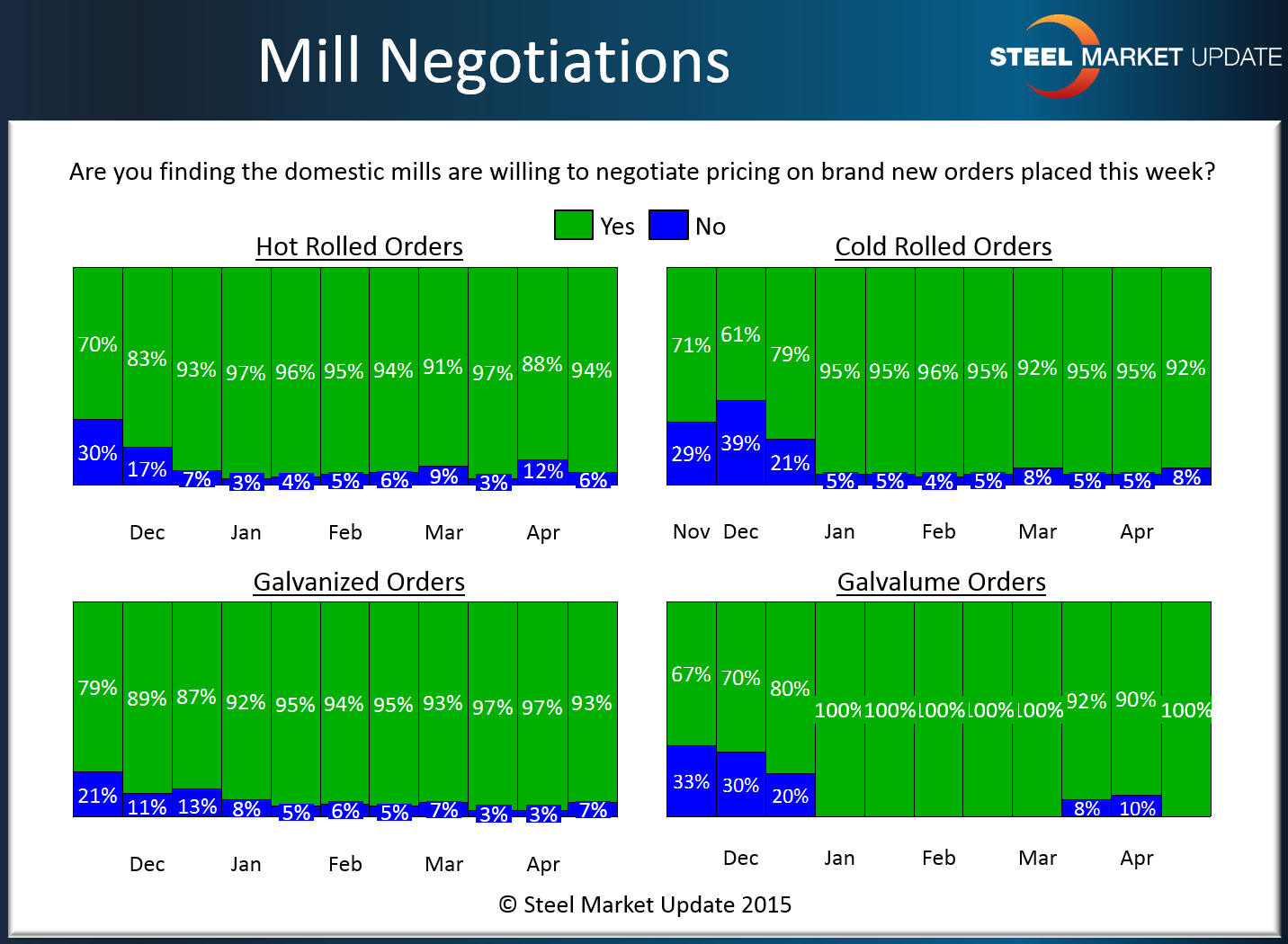

The willingness of the steel mills to negotiate flat rolled steel prices with end users and service center customers remains high based on the results from the Steel Market Update flat rolled steel survey. The issue is weak order books (see lead time article in today’s issue) and the domestic steel mills are looking for a catalyst which would bring flat rolled steel buyers back in the market. Inventory balance appears to be the biggest concern of the steel mills. Excessive inventories are being blamed on higher steel imports over the past 9 to 12 months. With higher inventories the need to buy is diminished and the ability to negotiate rest in the hands of the steel buyers. The mills need to fill their order books and, as one galvanized steel buyer put it to Steel Market Update in a conference call earlier this week, the mills are actively competing for business. When the order books begin to fill that need to compete will become tempered and we should see the green bars on the graphic below start to shorten.

The key is what will be the catalyst to move the buyers off their hands back to actively ordering steel? Some are thinking, both at the mill and service center level, the catalyst will be price increase announcements. The mills believe the slide in prices is perhaps a bit over-done as the mills have over-reacted to the flood of imports and the active competitive environment.

The graph speaks for itself, every flat rolled product pricing is negotiable at the domestic steel mills.

To view the interactive history of the graphic above, visit the Steel Mill Negotiations page on the Steel Market Update website here.