Market Data

April 30, 2015

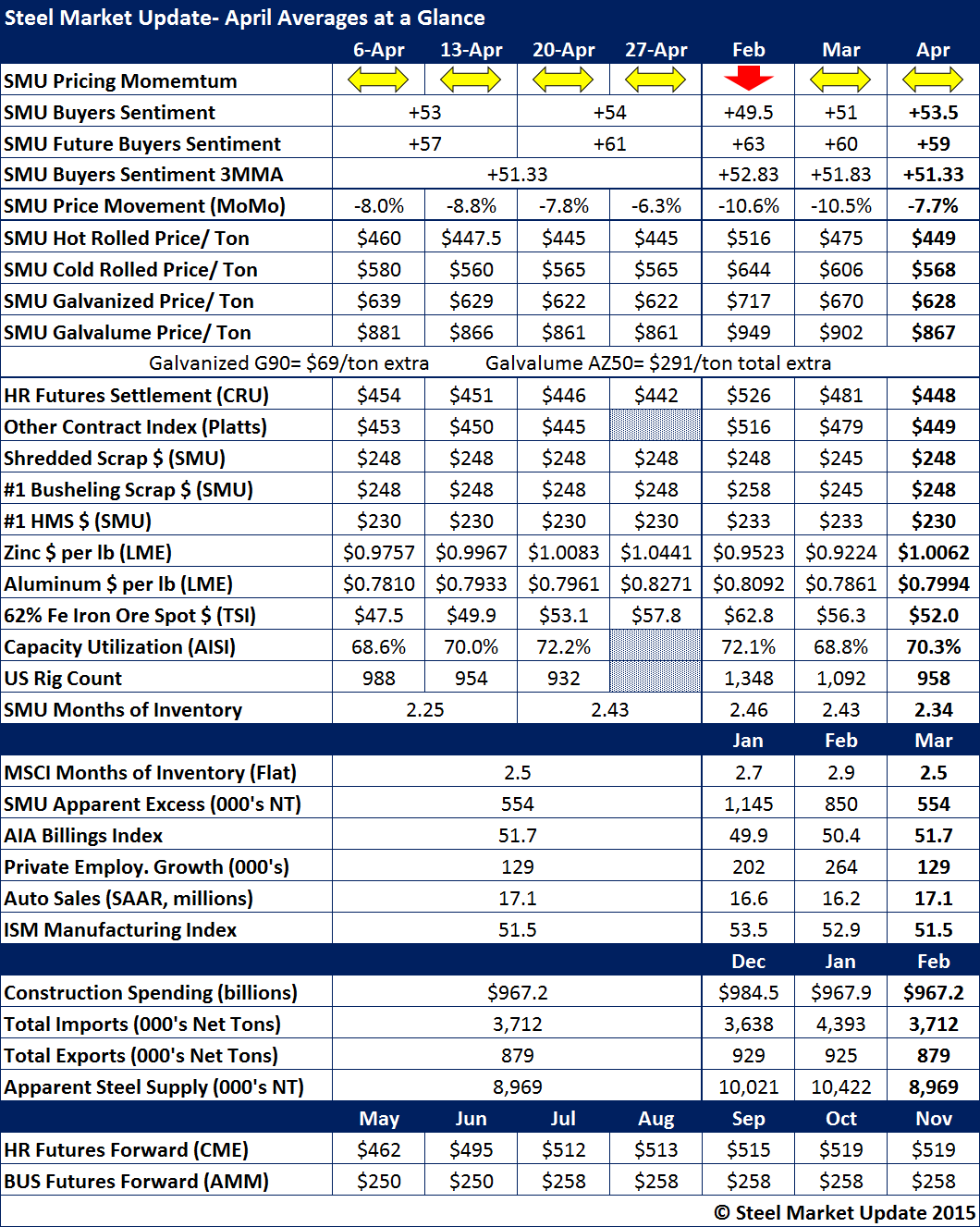

April 2015 Steel Data at a Glance

Written by John Packard

Today is the final day of April and, as is our habit, we will review much of the critical data reviewed or created during the month.

SMU Price Momentum Indicator remained at Neutral where it had been for the entire month. SMU has been forecasting a change in the momentum pushing prices from lower to either sideways or higher. Now that the domestic mills have announced price increases we will watch if the flow of orders improves and if it will result in higher prices from here.

SMU Steel Buyers Sentiment Indexes, both current and future, remained entrenched in the optimistic range of our Index. However, as you can see from the table below, both indexes and our 3 month moving average have been slipping over the past three months. The movement isn’t enough to cause concern, at least not yet.

Hot rolled prices averaged $449 per ton for the month. However, looking at the four weekly price averages the movement in pricing was modest at $15 per ton. The CRU averaged $448 per ton while Platts tied SMU at $449.

Zinc prices rose over the course of the month ending up at $1.0441 per pound. Aluminum rose as well and finished the month at $0.8271 per pound.

Iron ore is up in China ending the month at $57.8 per dry metric ton (62% Fe fines in China).