Prices

May 26, 2015

April Steel Imports at 3.5 Million Tons

Written by John Packard

The US Department of Commerce released preliminary census import data today (Tuesday) for the month of April. Steel Market Update (SMU) has analyzed the data for April and we have also revised our Trend Analysis for foreign steel imports for the month of May based on license data received through today.

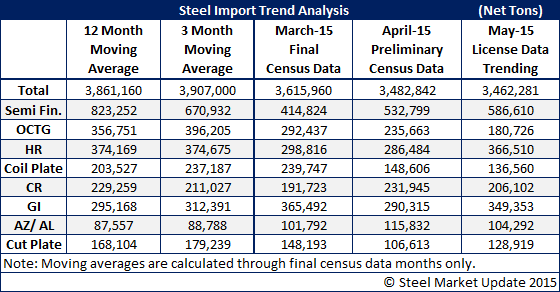

April Preliminary Census data has the month receiving just shy 3.5 million tons (net tons) which is 133,118 tons fewer than the month of March but are down 6.8 percent compared to April 2014. April tonnages were also below both the 12 month and 3 month moving averages which we show in the table below. That’s the good news.

The bad news is cold rolled tonnage continues to exceed both the 3MMA and 12MMA as the Chinese (and others) increase their exposure to the U.S. markets. Galvalume is another product facing increasing tonnage numbers as the 115,832 tons reported today exceed both the 3MMA and 12MMA.

When looking at the month of May (based on license data which is much less accurate than the Preliminary Census data) we believe the month will be similar to slightly lower than the month of April when all of the numbers finally come in. May is trending toward a 3.4 million ton month and we think it will come in at 3.2 to 3.4 million tons when all is said and done.

The areas of concern that we are seeing in May’s numbers are for hot rolled, which appears will come in close to the 3MMA and 12MMA. The galvanized numbers are quite strong trending toward 350,000 tons (which would be close to March’s levels). Galvalume continues to be an issue as well.

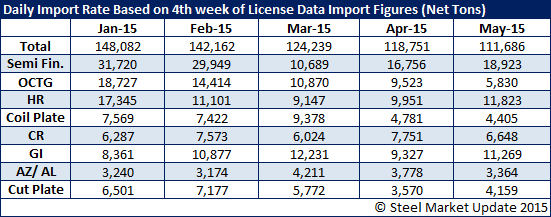

The table below compares the latest license data through May 26th to the same respective periods for the previous four months. This data is broken into tons per day for an easier comparison.