Prices

June 9, 2015

First Look at June Steel Import "TREND"

Written by John Packard

OK, everyone is looking for signs from the steel gods to see if (or when) foreign steel imports would begin to back off from the record high levels seen every month this year. So, we will tempt fate and show our readers a small sign. The US Department of Commerce released license data this afternoon through the 9 days of June. The data is obviously very early and can easily surprise in one direction or the other. But, we wanted to analyze the data to see how it compared to February, March, April and May as of the second week of the month.

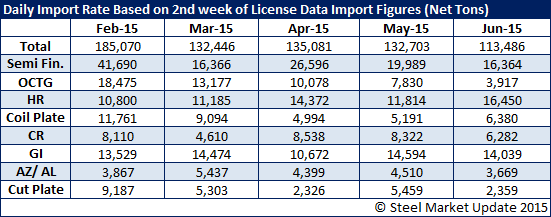

The table below shows each of those months and what the daily tonnage average was at this point in the month (net tons). As you can see February had the highest daily average at this point in the month at 185,070 tons per day. The other four months were fairly consistent at this point around 132,000 tons per day.

The good news (early at best and don’t bet your wife and kids on the end result for the month!) is we are now averaging 113,486 tons per day of import license requests.

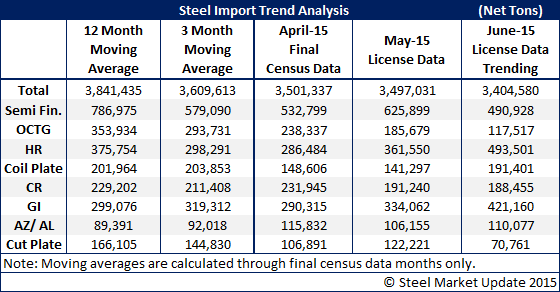

Even so, if we continue at the current rate we would see another 3.4 million net ton month. Our opinion (for what is it worth) is we think the number will end up around 3.2 million tons. The table below shows the latest import data for April, May, and June along with a three and twelve month moving average (through final April 2015 data only.)

We warn our readers, license data is very suspect. There could be swings of 200-300,000 tons (plus/minus) and this data should only be to look at a trend, not to predict a final total for the month.