Market Data

June 18, 2015

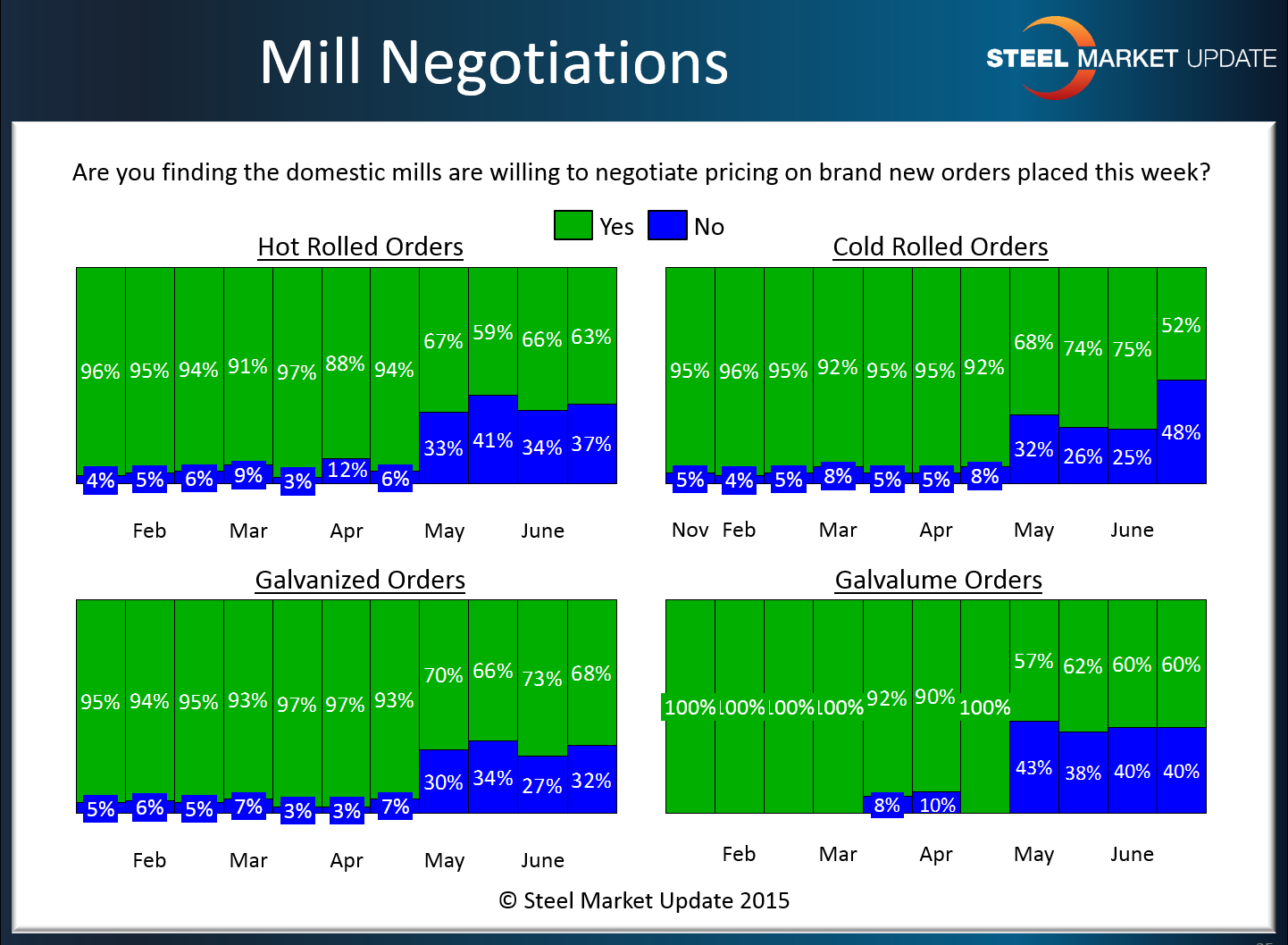

Mill Price Negotiations: Less Flexible Than Beginning of the Month

Written by John Packard

As with lead times, our survey respondents are reporting steel mills as slowly regressing and moving away from negotiating flat rolled steel prices. Although we are seeing movement, the percentage of respondents reporting the mills as still willing to negotiate hot rolled, cold rolled, galvanized and Galvalume continues to be more than 50 percent.

Hot rolled remained essentially unchanged with 63 percent of the respondents reporting the domestic mills as willing to negotiate HRC pricing.

Cold rolled saw the percentage drop from 75 percent to 52 percent.

Galvanized dropped slightly from 73 percent to 68 percent.

Galvalume remained the same as what we reported at the beginning of June at 60 percent.