Prices

June 21, 2015

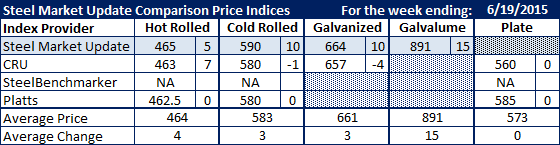

Comparison Price Indices: Are HRC and CRC Prices Stuck?

Written by John Packard

Hot rolled coil prices appear to be stuck in the $462 to $465 range. We have seen very little movement on HRC since the move made after the first price increase announcement back on April 28th.

Cold rolled, which SMU saw as being up $10 this past week, went nowhere according to Platts and CRU (down $1).

We also saw galvanized as being up $10 this past week while CRU saw it down $4 per ton. There is now only a $7 spread between the CRU and SMU indexes on GI.

We also saw Galvalume as being up this past week (+$15).

Plate prices went nowhere as both CRU and Platts kept their numbers the same.

It is Steel Market Update’s opinion that we are seeing movement in coated products due to the slightly improved order books at the domestic mills. This is most likely related to the dumping suits more than the price announcements.

This past week SMU had a number of steel mills admit to us that hot rolled is by far the weakest product and there is little to move prices from here. The last price increase announcement by the domestic mills has a target price of $480 per ton on hot rolled coil. We will have to wait to see if the mills can gain any traction on HRC this week.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.