Prices

July 14, 2015

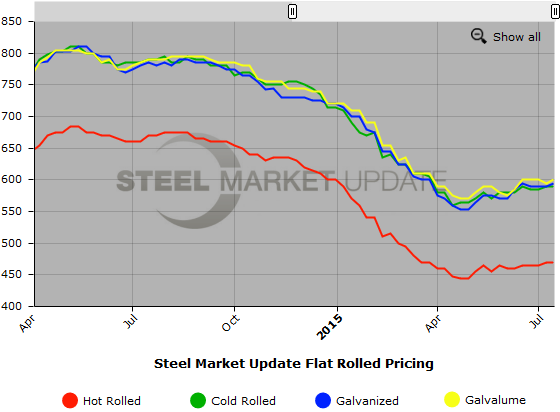

SMU Price Ranges & Indices: Still Nowhere to Go

Written by John Packard

Not too hot (prices aren’t rising at a breakneck pace – or at all for that matter), not too cold (and they aren’t dropping either – at least not yet), just about right (Goldilocks pricing). Of course this perspective will vary depending on your view of the market and your ability to pass through the current price levels to your end customer.

The mills might argue if the spot prices were $100 per ton higher than their current $460-$480 per ton price spread then prices would be “just about right.”

What isn’t Goldilocks is current apparent demand which some buyers coined as being “sluggish” and service centers continue to deal with heavy inventories. We will be interested in seeing the shipment and inventory data when the MSCI releases their figures later this week.

SMU was speaking with one service center executive who was complaining of having high inventories to the point of needing to find extra space outside of his own facility. He was finding that other warehouses were also holding high inventory levels.

His inventory was due to speculative buying on behalf of his contract customers in order to either lock in low prices or to protect against any disruption of supply should either ArcelorMittal or US Steel suffer from a labor outage.

Both end users and service centers reported modest to low purchase rates which is keeping lead times a reasonable levels with no concern regarding price increases or inventory disruptions. This has been translated into our prices this week.

Here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $460-$480 per ton ($23.00/cwt- $24.00/cwt) with an average of $470 per ton ($23.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton over last week while the upper end decreased $10 per ton. Our overall average is unchanged compared to one week ago. SMU price momentum for hot rolled steel is for prices to move higher over the next 30 to 60 days.

Hot Rolled Lead Times: 2-5 weeks.

Cold Rolled Coil: SMU Range is $580-$600 per ton ($29.00/cwt- $30.00/cwt) with an average of $590 per ton ($29.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range were unchanged compared to one week ago. Our average is the same compared to last week. We continue to believe that price momentum on cold rolled steel is for prices to move higher over the next 30 to 60 days.

Cold Rolled Lead Times: 4-7 weeks.

Galvanized Coil: SMU Base Price Range is $29.00/cwt-$30.50/cwt ($580-$610 per ton) with an average of $29.75/cwt ($595 per ton) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week while the upper end remained unchanged. Our overall average increased $5 per ton compared to one week ago. We continue to believe that price momentum on galvanized steel is for prices to move higher over the next 30 to 60 days.

Galvanized .060” G90 Benchmark: SMU Range is $649-$679 per net ton with an average of $664 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-8 weeks.

Galvalume Coil: SMU Base Price Range is $29.00/cwt-$31.00/cwt ($580-$620 per ton) with an average of $30.00/cwt ($600 per ton) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to one week ago while the upper end remained unchanged. Our overall average is up $5 per ton compared to last week. Our belief is momentum on Galvalume will be for higher prices over the next 30 to 60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $871-$911 per net ton with an average of $891 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-8 weeks.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.