Prices

September 22, 2015

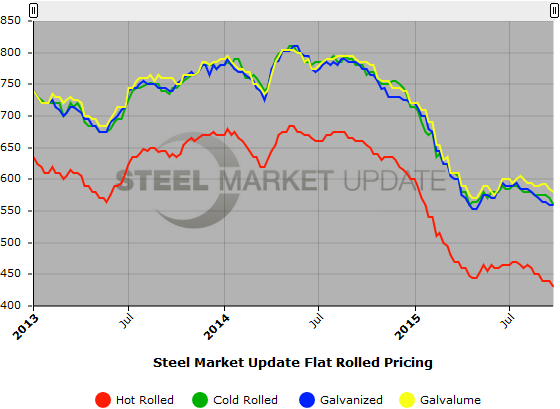

SMU Price Ranges & Indices: Coated Stronger than Uncoated Steels

Written by John Packard

Flat rolled steel buyers reported a weakening flat rolled steel market this week. Large buyers are now able to buy spot hot rolled at $410-$420 per ton with medium sized buyers seeing prices closer to $420-$440 per ton. We are seeing cold rolled and coated products as doing a little better as they have been running $120+ per ton spread between HRC base prices and those of cold rolled and coated steels. When the market is weak on all products we tend to see the spread closer to $100 per ton.

When asked if there were differences between fully integrated mill pricing and those of the mini-mills buyers told us that there were not. However, as long as US Steel and ArcelorMittal continue to work without a contract many of the spot orders that might have gone to them are going elsewhere. As one very large hot rolled buyer put it to us earlier today, “…mini’s lead time making it attractive as everyone wants hand to mouth inventory.”

Here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $410-$450 per ton ($20.50/cwt- $22.50/cwt) with an average of $430 per ton ($21.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range declined $10 per ton compared to our last published prices. Our overall average is $10 lower compared to one week ago. SMU price momentum for hot rolled steel is Neutral at the moment but we are seeing short term pockets of weakness which could take prices lower over the next couple of weeks.

Hot Rolled Lead Times: 2-4 weeks.

Cold Rolled Coil: SMU Range is $540-$580 per ton ($27.00/cwt- $29.00/cwt) with an average of $560 per ton ($28.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range declined $10 per ton compared to one week ago. Our overall average is down $10 compared to last week. SMU price momentum on cold rolled steel is at Neutral but, like hot rolled above, we could see a weakening in prices over the next two or three weeks.

Cold Rolled Lead Times: 4-7 weeks.

Galvanized Coil: SMU Base Price Range is $27.00/cwt-$29.00/cwt ($540-$580 per ton) with an average of $28.00/cwt ($560 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range are unchanged compared to last week. Our overall average is the same compared to one week ago. Our price momentum on galvanized steel is Neutral with some pockets of short term weakness.

Galvanized .060” G90 Benchmark: SMU Range is $609-$649 per net ton with an average of $629 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-7 weeks.

Galvalume Coil: SMU Base Price Range is $28.00/cwt-$30.00/cwt ($560-$600 per ton) with an average of $29.00/cwt ($580 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to week ago while the upper end decreased $10 per ton. Our overall average is down $5 compared to last week. Like the other flat rolled products mentioned above our price momentum for Galvalume is currently pointing towards Neutral but with a short term downward tilt.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $851-$891 per net ton with an average of $871 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.