Market Data

November 5, 2015

Steel Mill Negotiations: Let's Make a Deal

Written by John Packard

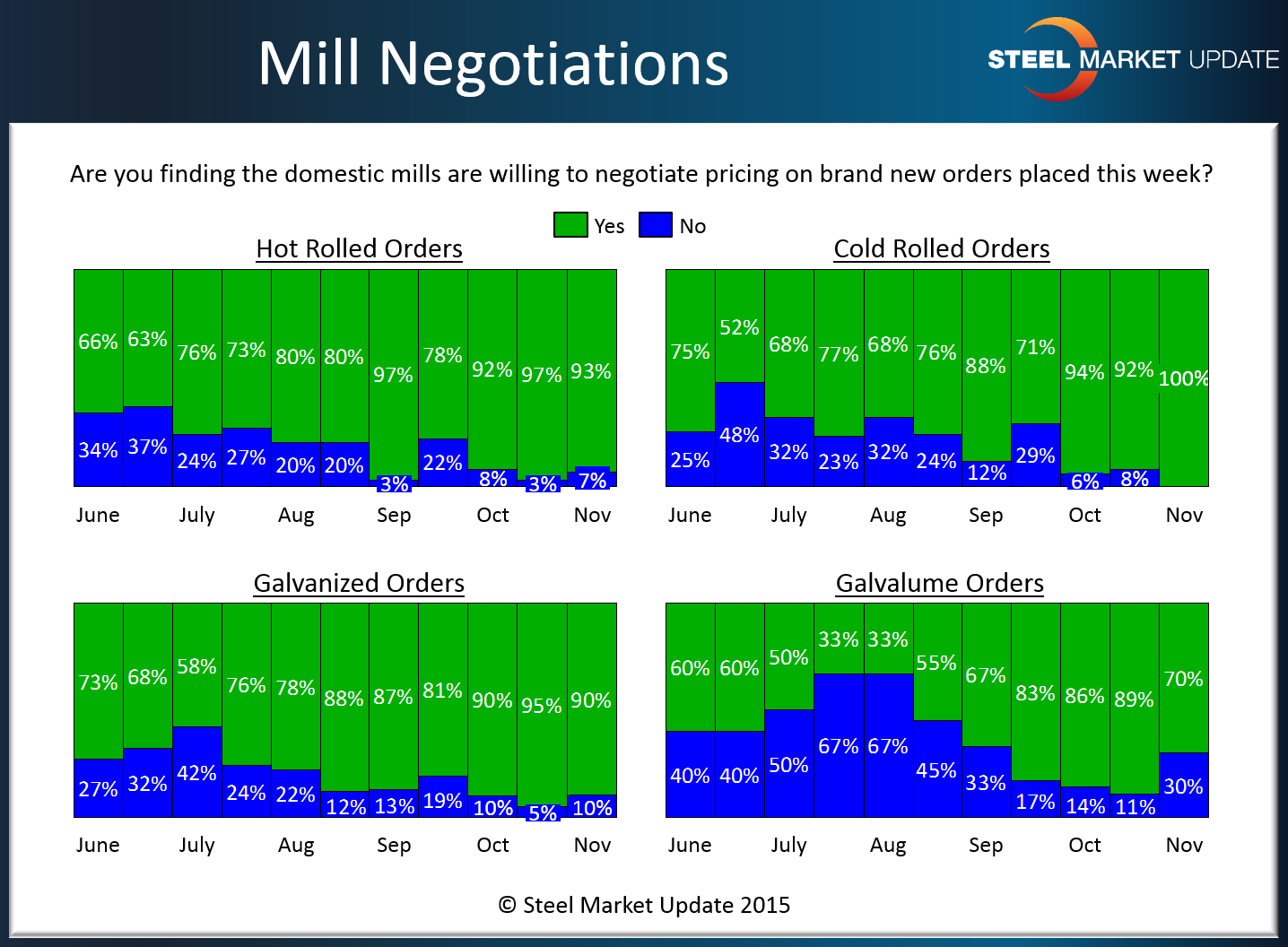

Our flat rolled steel survey respondents reported the domestic steel mills as willing to negotiate flat rolled steel prices on virtually every product.

The results of our flat rolled steel market analysis conducted throughout this week saw 93 percent of our respondents reporting benchmark hot rolled pricing as being negotiable. This is just about the same as what we have been reporting over the past 6 weeks.

Those responding to inquiries about cold rolled were unanimous in the opinion that CR prices are negotiable at the domestic mills. This is up 8 percent and is in line with what we have been reporting over the past 6 weeks or so.

Galvanized came in at 90 percent, down 5 percent from two weeks ago but in line with what we have been seeing over the past 6 weeks.

Galvalume was one product that saw the percentage of our respondents reporting the mills as negotiable on AZ products drop from 89 percent two weeks ago to 70 percent this week.

Here is what each product has looked like over the past six months:

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.