Market Data

December 3, 2015

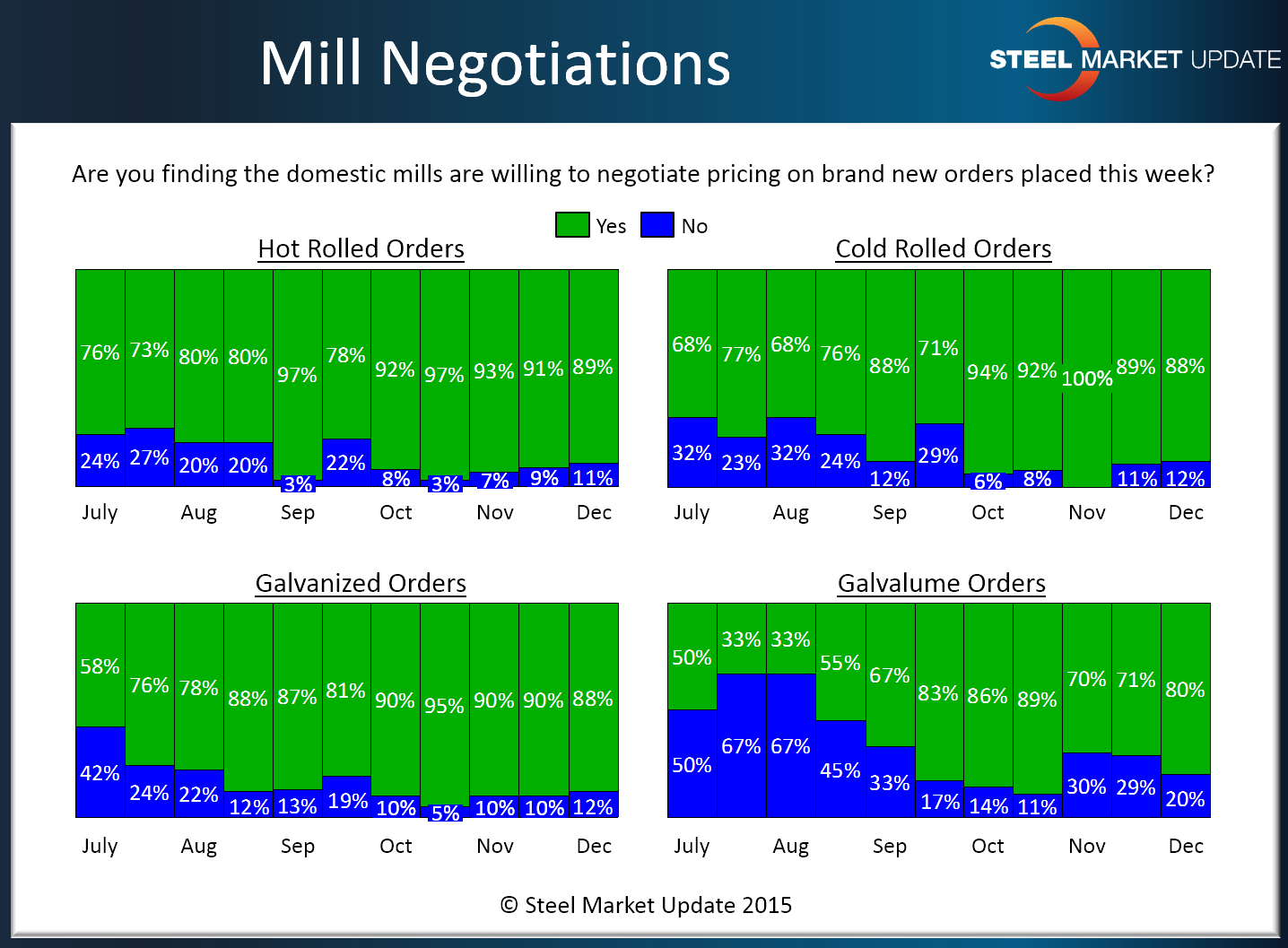

Mill Negotiations for Spot Flat Rolled Stuck in a Rut

Written by John Packard

Much like lead times, domestic mill spot price negotiations have been mired in the muck and not able to get any momentum going back to the spring of this year. Those responding to this week’s flat rolled steel market analysis are almost unanimous in their description of the willingness of the domestic mills to discuss pricing. It stands to reason with short lead times and the mills making as many moves as possible to eliminate unneeded capacity so far to no avail that price becomes the factor that determines where the order will be placed.

Here is how those responding to our early December survey saw the mills’ willingness to negotiate spot pricing by product:

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.