Prices

January 10, 2016

Partial Price Increases Taking Hold

Written by John Packard

Last week Steel Market Update conducted our early January 2016 flat rolled steel market analysis. Our Premium level customers got access to the results of our queries in the form of a Power Point presentation which puts the results into a historical context.

One of the unique line of questions asked were related to the early December 2015 price increase announcements and if the domestic mills have been able to collect some, all or none of the announced pricing. In early December most mills increased their prices by a minimum of $40 per ton with one (AK Steel) putting specific base prices out there with hot rolled at $420 per ton (+$60 over the SMU average low at the time) or $21.00/cwt base and cold rolled at $540 per ton ($27.00/cwt base) and galvanized at $550 per ton ($27.50/cwt base).

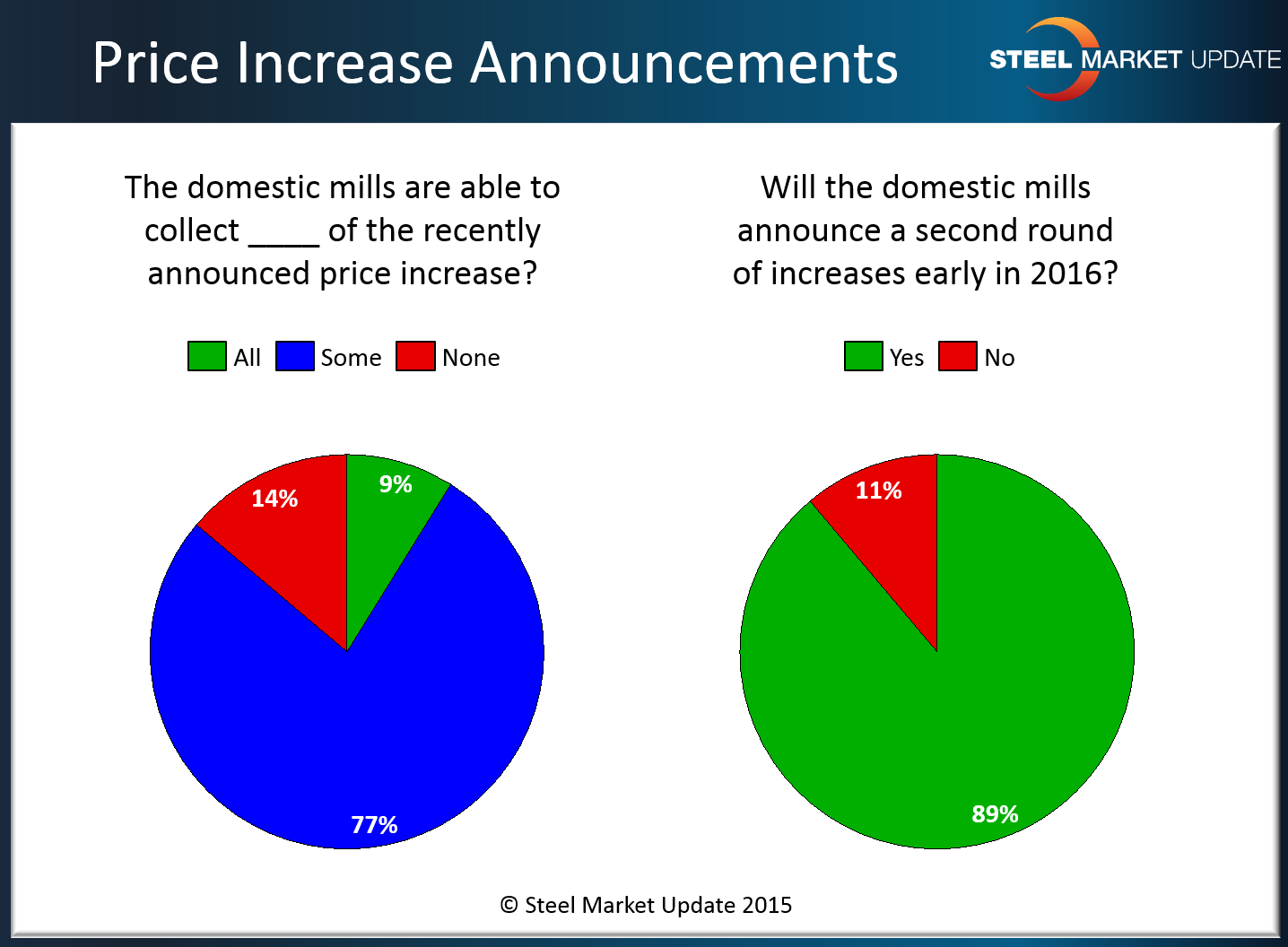

As you can see in the graphic below the vast majority of those responding to last week’s questionnaire (77 percent) reported the domestic mills as being able to collect some (partial) of the announced increase. Another 9 percent reported the mills as able to collect all of the increase and the balance (14 percent) told SMU that none of the increase had yet been passed through to their company.

We pointed out last week that those responding to our questionnaire were reporting that they expect the domestic steel mills to announce a new round of price increases early this year. Exactly what that means remains to be seen.

What Our Respondents Had to Say

“Hope that they collect all, but do not think any rise will be swift. All factors domestic mills use to base an increase are in play i.e., trade cases, capacity, raw material cost; but are not focused on a sluggish economy, even in light of an election year. Banks are still playing the ‘big short.'” Trading Company

“Not hearing of any push back from anyone at this point. Scrap going up in January will help support it.” Service Center

“Some of the increase has been recovered on plate products; whereas all of HRC increases have been accepted.” Steel Mill

“We have a lot of inventory and haven’t “tested” the price increases.” Manufacturing Company